License Agreement

PLEASE

READ THIS LICENSE CAREFULLY. By

using the software supplied with this licence (the “Software”) you agree

to be bound by the terms of this licence.

License & Limited Warranty

This is a license, this product is not sold.

THIS IS A NON TRANSFERABLE LICENSE, granted

to the end user, by GENESIS PTY LTD Registration (hereinafter called

GENESIS) with its mailing address at PO Box 199, Patong, Phuket. Thailand.

83150. The software marketed as AUTO EASY ULTIMATE is licensed to you

as the user. It is not sold.

I. COPYRIGHT INFORMATION

Australian copyright laws and international

copyright treaties protect this software program, and any documentation.

By using this software, you acknowledge that you have read, understood,

and agree to be bound by the provisions of this license.

II. LICENSE, COPY AND USE RESTRICTIONS

GENESIS licenses (not sells) the AUTO EASY

software to the end user, for use on any computer for which the software

was designed This means that GENESIS allows you to use the software on

a single machine. You may not use the software in a multiple computer,

multi-user, or network arrangement without prior consent from GENESIS.

You may not remove the GENESIS copyright

notices from any manuals or software provided. All copies, together with

the original, must be kept in control of the location it is provided to.

You may not make any changes or modifications

to the software, you may not delete any of the files contained in the

software, and you may not decompile, disassemble, or otherwise reverse

engineer the software. The software is not for sale. You are not to sublicense,

rent, lend, lease, donate, sell, loan, pledge, transfer, or distribute

copies.

III LIMITED WARRANTY

1.0

GENESIS warrants that the media on which the software is recorded and

the documentation provided with it are free from defects in materials

and workmanship under normal use. GENESIS warrants that the software itself

will perform substantially in accordance with the specifications set forth

in the documentation provided with it.

1.1

The above express warranties are made for a period of 3 months from the

date the software is delivered to you as the user.

Obligations of GENESIS during the warranty

period:

1.2

GENESIS will replace any media, which proves defective in materials or

workmanship, without additional charge or on an exchange basis.

1.3

GENESIS will either replace or repair without additional charge, any software

that does not perform in substantial accordance with the specification

in the documentation. Delivering to you a corrected copy of the software

or corrective code will do this.

1.4

If GENESIS is unable to replace defective documentation or defective media

or if GENESIS is unable to provide a corrected copy of the software or

documentation within a reasonable time, GENESIS will refund the license

fees paid for use of the software.

Exclusion and Disclaimer of Other Warranties:

1.5

GENESIS does not warrant that the functions contained in the software

will meet your requirements or that the operation of the software will

be uninterrupted or error free. The warranty does not cover any media

or documentation, which has been subject to damage, or abuse by you. The

software warranty does not cover any copy of the software, which has been

altered or changed in any way by you or others. GENESIS is not responsible

for problems caused by changes in the operating characteristics of the

computer hardware or operating system, which are made after the delivery

of the software.

1.6

EXCEPT AS SPECIFICALLY PROVIDED HEREIN, GENESIS MAKES NO EXPRESS OR IMPLIED

WARRANTIES WHATSOEVER, AND EXPRESSLY DISCLAIMS THE IMPLIED WARRANTIES

OF MERCHANT ABILITY AND FITNESS FOR A PARTICULAR PURPOSE.

IN THE CASE OF A USER OF THE SOFTWARE WHO

IS A CONSUMER WITHIN THE MEANING OF THE TRADE PRACTICES ACT:

(i) Except for any other conditions or warranties

issued in writing by GENESIS and except for those conditions and warranties

implied by the Trade Practices Act or other sale of goods or consumer

protection legislation which may not be excluded you agree that there

are no additional implied conditions or warranties herein or collateral

contracts herewith (except such as may be in writing and signed by a duly

authorised representative of GENESIS);

(ii) to the extent that the goods

or services the subject of these provisions are goods or services of a

kind not ordinarily acquired for personal, domestic or household use or

consumption (within the meaning of the Trade Practices Act) the liability

of GENESIS to you for breach of warranty or condition (other than a warranty

or condition implied by section 69 of the Trade Practices Act) or for

breach of any duty of care shall in all cases be limited at the option

of GENESIS in the case of goods to any one or more of the replacement

of the goods or the supply of equivalent goods, the repair of goods, the

payment of the cost of replacing the goods or of acquiring equivalent

goods or the payment of having goods repaired and in the case of services

to the supplying of services again or the payment of the cost of having

the services supplied again and (without limiting the foregoing) shall

not include any liability in respect of or arising out of or in connection

with any special consequential direct or indirect loss, damage, harm or

injury suffered or incurred as a result of such breach.

Your obligations under the Warranties:

1.7 You must call GENESIS’s

support line for an authorisation to return any defective item during

the warranty period. If GENESIS's customer service representative is unable

to correct your problem by telephone, you will be provided with a return

authorisation number and an address for returning the defective item for

warranty service or replacement. You must insure any defective item being

returned because GENESIS does not assume the risk of loss or damage while

in transit.

Other Conditions:

1.8

The warranties set forth above are in lieu of all other express and implied

warranties, whether oral, written, or implied, and the remedies set forth

above are your sole and exclusive remedies. Only an officer of GENESIS

may make modifications to this warranty, or additional warranties binding

to GENESIS. Accordingly, additional statements such as advertising or

presentations, whether oral or written, do not constitute warranties by

GENESIS and should not be relied upon as such. This warranty gives you

specific legal rights, and you may also have additional rights, which

may vary from country to country.

IV. LIMITATION OF LIABILITY

TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE

LAW GENESIS AND ITS SUPPLIERS SHALL NOT, IN ANY EVENT, BE LIABLE FOR SPECIAL,

INCIDENTAL, CONSEQUENTIAL, INDIRECT, OR OTHER SIMILAR DAMAGES, EVEN IF

GENESIS OR ITS SUPPLIERS HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

In no event shall GENESIS’s liability exceed the license fees paid for

the right to use the licensed software.

V. INTEGRATION

This license including the full text of

the Limited Warranty and the Limitation of Liability, constitutes the

entire agreement and understanding between the parties and supersedes

any prior license or understanding whether oral or written, relating to

the subject of this license. This license may only be modified by a written

agreement signed by Genesis Pty Ltd.

You may use the software as long as you

like provided you do not violate the copyright and you follow the above

rules.

Title to the software, related documentation,

and any copies are retained by GENESIS PTY LTD.

Copyright © 2002 Genesis Pty Ltd. All rights

reserved

Genesis Pty Ltd

PO Box 1484

Fremantle

Western Australia 6959

Chart

Of Accounts

When you keep books for a business or organisation, you

want to track where your income comes from, where you put it, what your

expenses are for, and what you use to pay them. You track this flow of

money through a list of accounts called the chart of accounts. Accounts

include the follwing:

¨

Balance sheet accounts

¨

Income accounts

¨

Expense accounts

¨

Cost of goods sold accounts

¨

Non-posting accounts (includes

purchase orders and estimates and does not appear on your balance sheet)

Some of these accounts are created for you automatically

for example, the first time you create an invoice or statement charge,

Auto Easy automatically creates an accounts receivable (A/R) account.

Other accounts you'll add, at any time you can create and modify your

accounts as needed.

Types of accounts

Balance

sheet accounts

Your chart of accounts includes balance sheet accounts.

These accounts track the following:

¨

What you have (assets)

¨

What people owe you (accounts

receivable)

¨

What your company owes

to other people (accounts payable and other liabilities)

¨

The net worth of your company

(equity)

¨

Retained Earnings (profit

carried forward from previous tax years)

The following table describes the various types of Auto

Easy balance sheet accounts.

|

Balance sheet

account type |

Auto Easy

account type |

Use to track |

|

Asset |

|

What you have and what is owed to you |

|

|

Bank |

Transactions in cheque or savings accounts. Add

one bank account for each account your business operates. You can also

use this type of account for cash purchases. |

|

|

Accounts Receivable (AR) |

Transactions between you and your customers, including

invoices, payments from customers, deposits of customer payments, refunds,

and credits. Accounts receivable is automatically created. |

|

|

Other Current Asset |

Assets that are likely to be converted to cash

or used within a year, such as the value of your stock on hand. |

|

|

Fixed Asset |

Represents the depreciable assets your business

owns that aren’t liquid such as equipment, furniture or a building. |

|

|

Other Asset |

Any asset that is neither a current or fixed asset |

|

|

|

|

|

Liability |

|

What your company owes |

|

|

Accounts Payable (AP) |

Comprises of outstanding bills. When you first

enter a bill, Auto Easy creates an AP account |

|

|

Credit Card |

Credit card transactions for your business purchases

or expenses |

|

|

Other Current Liability |

Liabilities that are scheduled to be paid within

the next 12 months, such as GST, payroll liabilities and short-term loans. |

|

|

Long Term Liabilities |

Liabilities such as loans or mortgages scheduled

to be paid over periods longer than 12 months. |

|

|

|

|

|

Equity |

|

Net worth of your business |

|

|

Equity |

Comprises of the following:

v

Investment of capital in

the business by the owners

v

Net profit from operating

the business during the current financial year that have not been distributed

to the owners

v

Retained earnings, or net

profits from earlier periods that have been carried forward into the current

financial year. |

Balances for balance sheet accounts

The Chart of Accounts window shows a balance

for each balance sheet account (except for the special equity account,

Retained Earnings). In Auto Easy, each balance sheet account has its own

register, just like your bank account register. The register shows every

transaction for that account, as well as the account balance.

Income and expense accounts

Income and expense accounts track the sources of your

income and the purpose of each expense. When you record transactions in

one of your balance sheet accounts, you usually assign the amount of the

transaction to one or more income or expense accounts. For example, not

only do you record that you took money out of your current account, but

also you keep track of what you spent the money on.

There are no registers for income and expense accounts,

but your can create reports to show totals for these accounts over a period

of lime.

Cost

of goods sold (COGS) account

The account type "cost of goods sold" (or

COGS or cost of sales) is grouped with income and expense accounts even

though it is a separate account type. Many businesses have one cost of

goods sold account, which is similar to an expense account. COGS contain

all expenses that are direct costs of your sales, such as items for a

job or inventory. When you use inventory items to track purchases and

sales of inventory, Auto Easy automatically calculates the cost of goods

sold every time you sell an item.

Accounting

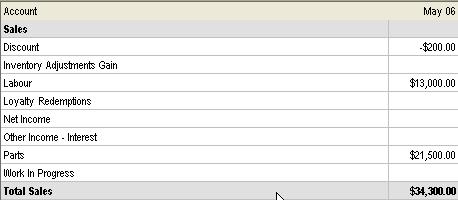

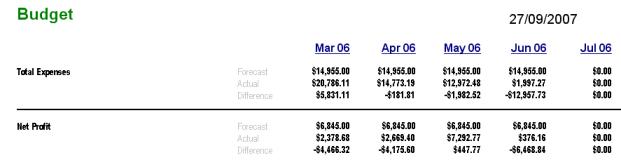

Reports

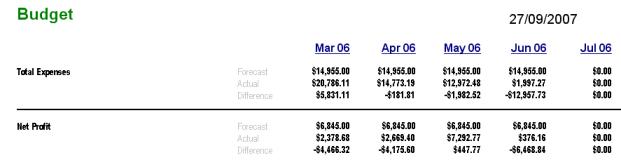

The value and performance of your company can be summarised

by two reports: The balance sheet and profit and loss statement. How you

set up your chart of accounts will greatly influence the level of detail

you record on these reports

Your Business’s Balance Sheet

A balance sheet is a financial snapshot of your company

on a selected date basis. This report is useful when applying for a business

loan or at year-end to get an accounting of your business’s equity, assets

and liabilities.

Your

Business’s Profit & Loss Statement

The income statement

shows the performance of a business over a period of time. Income is reported

for a month, quarter, year or some other period of time. The income statement

lists your income, cost of sales, and expense accounts. (Cost of sales

and expense accounts are very similar. Businesses use the two different

account types to discriminate between costs directly related to sales

and the costs of running a business) Cost of sales and expenses are subtracted

from income to calculate the profit (or loss) for the period. this is

why the income statement is also called a profit & Loss Statement.

Where the Profit & Loss Statement meets the Income Statement There

is one link between the two financial statements It is an important link

and a key concept The net profit or loss of the Income statement is automatically

posted to the equity section of the balance sheet.

Double-Entry

Accounting

Double-entry accounting is the accepted method of accounting

worldwide. Double-entry accounting, as the name suggests, requires two

entries for every financial event, but what is an entry? An entry is made

when you assign an amount to an account.

If you were to put $100 in the company cheque account,

the entry would look like this:

Account

Amount

Company Cheque

$100.00

However, this entry reflects only one side of the transaction.

It doesn't tell you where the money came from. If this $100 originated

from the sale of a tyre, the entry would look like this:

Account

Amount

Tyre Sale

$100.00

These two entries when put together, make up one double-entry

that looks like this:

Account

Amount

Company Cheque $100.00

Tyre Sale

$100.00

As you can see, you now have a double entry,

reflecting where the money came from and where it went. This is the basic

function of double-entry accounting.

Debits

& Credits

Once you’ve mastered the different account types and

the two financial statements. The next concept to learn is debits and

credits. In double-entry accounting, every dollar amount is categorised

as either a debit amount or a credit amount. And each of the six account

types - asset, liability, equity, income, cost of sales, and expense -is

classified as either a debit account or a credit account. Asset and expense

accounts are called debit accounts because their balances are usually

debit amounts. The other four account types are credit accounts because

their balances are usually credit amounts.

A good working knowledge of credits and debits is helpful,

but not required to use Auto Easy Ultimate. In almost every transaction,

Auto Easy calculates the correct debit and credit amounts for you

Because debits and credits do not follow any obvious

rule, it is difficult to remember which accounts normally have a credit

balance and which normally have a debit balance. If you remember that

assets are debits it will follow that liabilities and equity are credits.

If you remember that sales are credits it will follow that cost of sales

and expenses are debits

On the balance sheet, assets - things you own-are good

and are debits. Liabilities - things you owe are bad and are credits.

On the income statement, income accounts – money in - are good and are

credits Expense accounts - money out - are bad and are debits, The following

chart shows the accounts and the sign they carry

|

Account |

Normal Sign |

Description |

|

Assets |

Debit |

All the things a business owns |

|

Liabilities |

Credit |

All the things a business owes |

|

Equity |

Credit |

The difference between what is owned and what is owed |

|

Income |

Credit |

The money charged for products and / or services |

|

Cost Of Sales |

Debit |

The direct cost of products and / or services sold |

|

Expenses |

Debit |

The money charged to operate the business |

Conclusion

As you might have guessed double entry accounting can

and has caused a great deal of confusion. A single entry appears simple

but as different types of entries are added to the business’s books, the

system gets more difficult and complex to understand. Auto Easy Ultimate

has been designed to minimise the complexities of double entry accounting,

however it is still helpful to have a basic understanding of the principles

applied.

Tax

Reporting –

Cash & Accrual Accounting Methods

An accounting method is a set of rules that determines

when and how you report your income and expenses for tax purposes.

Cash basis

Many small businesses track income at the time they

receive the money, and expenses when they pay the bills, This method is

known as bookkeeping on a cash basis If you've been recording deposits

of your customers' payments but have not been including the money customers

owe you as part of your income, you've been using cash basis. Similarly,

if you've been tracking expenses at the time you pay them, rather than

at the time you first receive the bills, you've been using cash basis.

Accrual basis

In bookkeeping on an accrual basis, you record income

at the time of the sale, not at the time you receive the payment. Similarly,

you enter expenses when you receive the bill, not when you pay it. Accountants

usually recommend accrual basis because it gives you a better picture

of how your business is doing.

The choice is yours

Auto Easy makes bookkeeping really simple by enabling

you to enter transactions the same way no matter which method you use

for taxes. At any time you can create tax reports that follow either method,

so you are not "stuck" with one method.

Hardware

& Software Requirements

To run Auto Easy Ultimate, you need the following equipment

and software:

v

IBM OR 100% compatible

computer running a Pentium 1GHz Processor (or higher).

v

Minimum of 512MB (megabytes)

of RAM (random access memory).

v

Hard disk dive with a minimum

of 500MB free space

v

CD-ROM Drive minimum 10

speed

v

SVGA monitor or better;

capable of displaying a minimum of 256 colours and 1024 x 768 resolution.

v

56k Modem, ISDN, ADSL or

satellite connection

v

Windows 2000, ME, Windows

XP, Vista or Windows 7including Internet Explorer 6.0 (or higher) or

Netscape for

accessing Internet services.

v

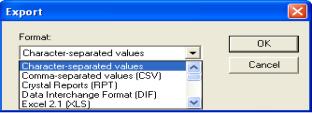

Microsoft Word 6.0 (or

later version) & Excel 97 (or later version) if you plan to export

data to

Microsoft applications

v

Printer, including specified

driver loaded with defaults set to A4 page size

Network

requirements

Auto Easy Ultimate network requirements are the same

whether you are sharing a company file or printing to a network printer:

v

Windows Server or Terminal

Server to share the company file

or

v

Peer-to-Peer network using

Windows XP or Vista

Additional Sever Requirements for Multi-User Network

v

Pentium 1Ghz Processor

(or higher)

v

512MB RAM (Random Access

Memory)

v

Hard disk with 500MB free

space

Multi-User

Installation Requirements

Auto Easy Ultimate for multiple users must be licensed

for each machine. You must have a copy of Auto Easy Ultimate loaded on

each of the computers you plan to network. Each user should have read/write

access and create/delete rights to the directory where the company file

is stored. Check your network software for instructions on how to get

your computers networked and how to give each user read/write access.

If your Auto Easy Ultimate CD is mounted on a server or shared CD-ROM

drive, you can install from the mounted CD, but you cannot install across

the network to a remote computer. That is, you must be sitting at the

computer you're installing to, but you should store the company file on

the shared resource.

For peer-to-peer network users

Peer-to-peer networks are networks that do not use a

dedicated file server. This means that all the computers on the network

have the option to share their resources. There is not one machine that

is used only to allow other computers to share files. An example of a

peer-to-peer network would be two or more connected computers running

Window 95, Windows 98, Widows 2000, Windows NT 4.0 or ME.

It is important that each computer use a unique copy

of Auto Easy Ultimate installed with a unique unlock code; these can be

obtained from Genesis Pty Ltd.

It is important that yon choose one location for your

company file. The location you choose should be accessible from all of

the computers that need to use Auto Easy Ultimate. Yon may want to put

the company file on the computer of the person who uses Auto Easy Ultimate

the most. This allows that person to have the fastest access to the Auto

Easy company file.

For client-server network users

Client-server networks are networks in which there

is at least one computer dedicated to sharing files, printers, or other

resources. This computer is usually not used by individuals to do their

daily work.

In a client-server network, you will most likely put

the company file on the server in a location that is accessible by all

of the computers that need to use Auto Easy Ultimate. Each computer, except

for the file server, must have a copy of Auto Easy Ultimate installed

with a unique Unlock code unless you are using a terminal server in which

case only one unlock key is required.

Loading

The Software

Installation Procedure

Insert the CD into your drive, the install program

will execute automatically. Select install when prompted – The default

directory is C:\Program Files\Auto Easy Ultimate, if you wish to copy

the files to a different location select the change directory option during

the install.

When all the files have been copied, you maybe requested

to restart your computer. Please select restart before attempting o run

Auto Easy Ultimate.

To open the program select the desktop icon Auto

Easy Ultimate or start / programs / Auto Easy Ultimate.

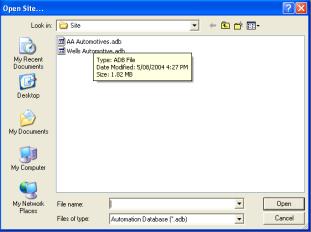

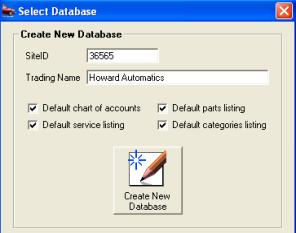

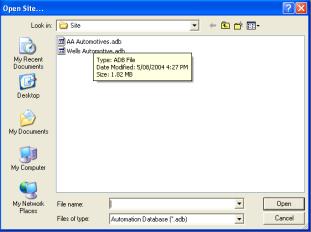

Either selection will start the program for the first

time; You will need to create a new database or open the existing training

file AA Automotives, To open the training data select open existing database

and select AA Automotives from the file selection. To create new databases

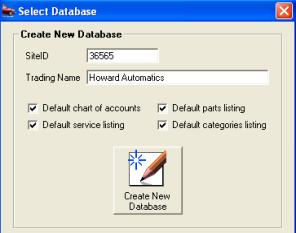

enter a numeric site id. (max 8 characters – (DO NOT USE ALPHAS).

Next enter your site name and de-select the default parts, services,

categories and chart of account options if you do not want to use them.

Note

Windows Vista Installs – Version

2.5.2 or higher prompts the user to select a modified installation process

when loading Auto Easy Ultimate onto Windows Vista. Please note it is

not possible with this operating system to maintain the integrity of our

program when updates are provided if Auto Easy is loaded in the Program

Files folder

|

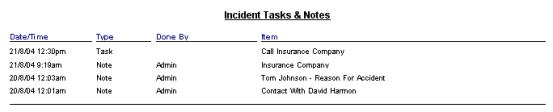

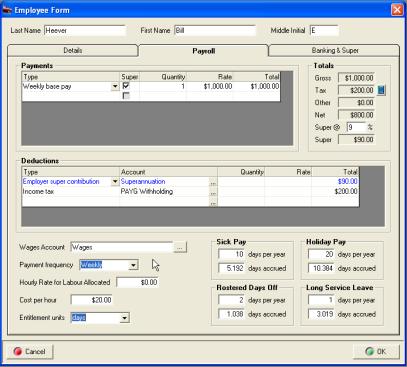

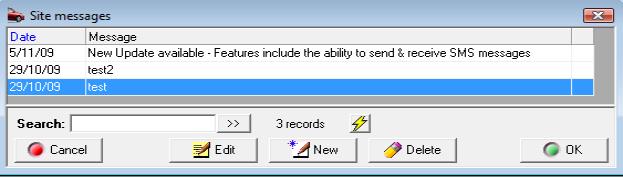

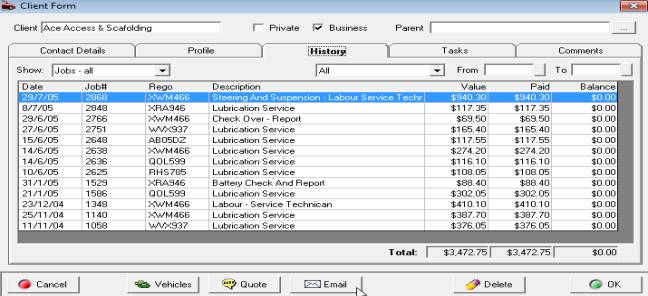

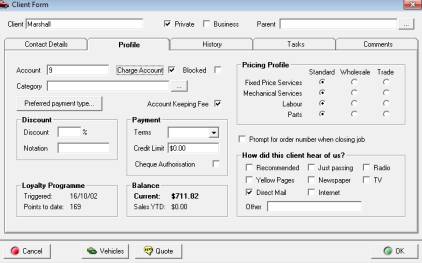

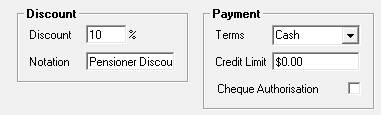

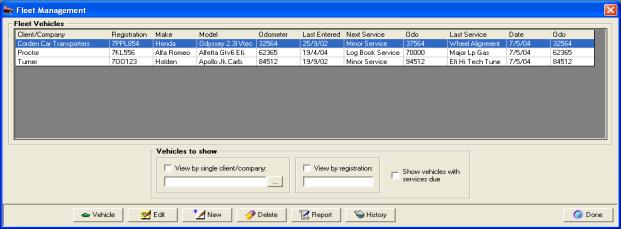

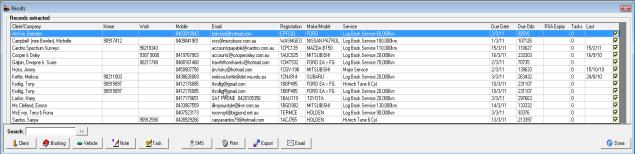

Fig 2.01 Selecting Database On Opening |

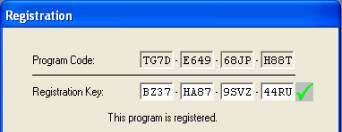

A registration box is displayed before the opening

screen. The registration can be bypassed; however the product will only

run for 30 days after which you will have to contact Genesis Pty. Ltd.

for a registration code.

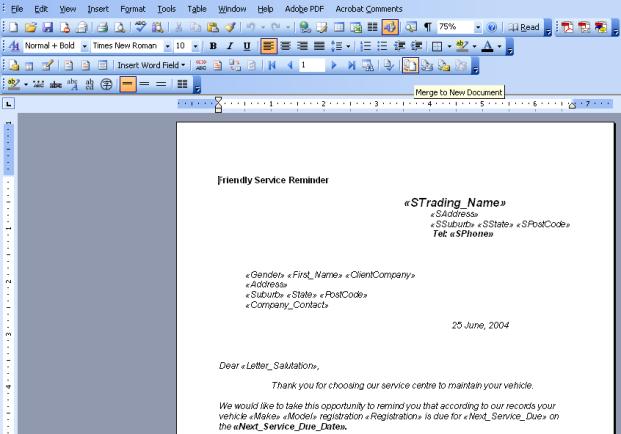

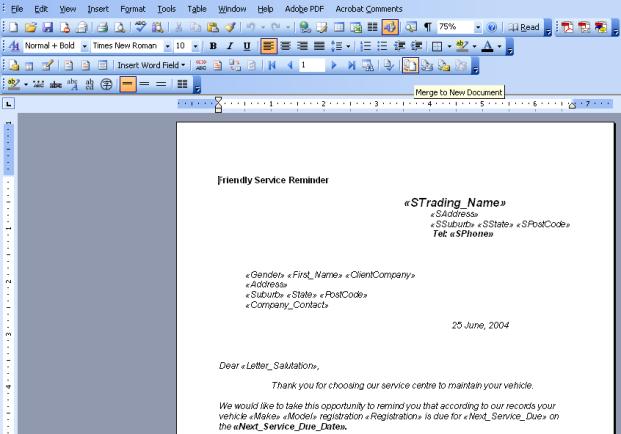

If you wish to send communications to your clients

you will need to install a copy of Word for Windows 2000 or later to perform

mail merge functions. Auto Easy through the database extract function

has links to this Microsoft product

If you wish to create a new site enter a four digit

number into the site id field (no alphas) followed by the business name

in the trading name. You can also choose to load the default databases.

|

A registration box is displayed before the opening

screen. The registration can be bypassed; however the product will only

run for 30 days after which you will have to contact Genesis Pty. Ltd.

for a registration code.

If you wish to send letters you will need to install

a copy of Word for Windows95 or later to perform mail merge functions.

Auto Easy through the database extract function has links to this Microsoft

product.

Importing Data

It is possible to import data from Auto Easy 2000

(© Genesis Australasia) directly into Auto Easy Ultimate. There are 2

options available:

1)

No Transactions: Enter the cut-off date (usually the current

date), do not select the recreate transaction option, and select the import

button. You will need to choose the directory that you are importing data

from although this will default to the C:\Workshop directory if this exists

on your machine. Messages will be displayed as the data is converted to

Auto Easy Ultimate Format.

The no transaction option will import your databases

from Auto Easy 2000 into Auto Easy Ultimate; there will however be no

transaction history, debtors opening balances will have been converted

and any receipts will have been deposited to a suspense account (Bank).

2)

Import Transactions:

To import databases and

associated transactions select the recreate transactions option, the cut-off

date when choosing this option should be the date up to which you have

paid your creditors and banked receipts. These values will be credited

and debited to a suspense account. There will be some editing required

when opening your data for the first time. It is suggested you contact

Genesis for advice on how to do this as it will vary according to each

import.

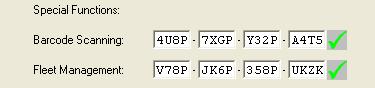

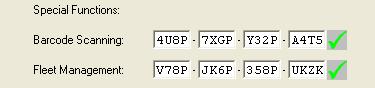

Registering

Auto Easy Ultimate

Firstly you will need to Provide Genesis with the

16 alpha / numeric program code generated on installation. Genesis will

provide you with a unique unlock code for the program plus additional

codes for bar code scanning and fleet management if required. On receiving

the unlock codes there are 2 ways to register your program:

1)

From the registration box

that is displayed as an unregistered copy is loaded – Enter the unlock

code provided into the appropriate field

2)

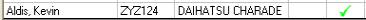

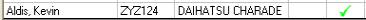

From the opening screen

select File / Registration – The registration box is displayed a red cross

at the end of a line indicates that the program or module is not registered.

A green tick indicates a successful registration

To save your registration key select OK at the bottom

of the registration display.

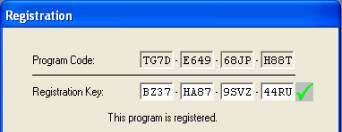

|

Fig

2.02 Program code & Registration key |

Registration keys are unique and apply ONLY to

the computer the program is installed on, if for any reason you need to

reload the program contact Genesis for a new set of registration keys.

If you are operating on a network each machine will require a separate

registration key. Please ensure you retain these codes in a safe place

for future reference.

|

Site Set- Up

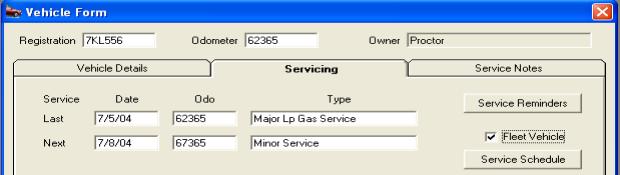

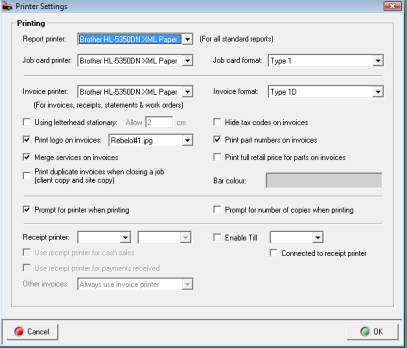

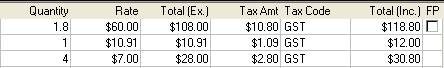

Printer

Settings: Select Site /

Printer Settings from the drop down menu, you have the option to print

to two machines. The report printer will print job cards and all other

reports, the invoice printer will only print invoices (suggested if you

use letterhead stationery). The report and invoice printers can be the

same if multiple units are not in use.

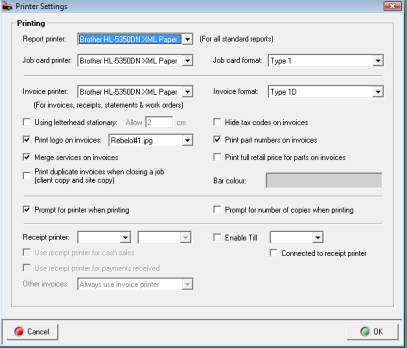

|

Fig 2.03 Printer Settings |

Printer

Selection: Auto Easy allows

you to connect three standard and one receipt printer. Select the required

printer by clicking on the arrow to the right of the report printer field.

Highlight the device and double click the details are displayed. Perform

the same process for the invoice and job card printer.

Job

Card & Invoice Format: There

are 3 types of job card and 7 types of invoice formats it is suggested

that you select each type and test print to determine which layout you

wish to use.

Using

Letterhead Stationery: Selecting

will not print the site / location address and phone details on the invoice.

The header spacing can also be adjusted by entering values into the

allow field.

|

Print

Logos On Invoice: If you wish

to customise the display convert your logo into a JPEG or BMP file and

copy into the Working directory\logos folder. To select the logo flag

the print logos on invoice selection, the drop down list will be displayed.

Point to the required file and double mouse click, the file name is displayed

in the logos field.

Merge

Services On Invoice: When selected

does not define fixed price & mechanical services.

Duplicate

Invoices: Allows the operator to automatically print

two copies of the invoice with sign-off text being printed on the client’s

copy. To enter the text required access Messages / Invoice Sign-Off Text.

Hide

Tax Codes: Set this to true

if you don not want the tax codes displayed against each line item on

the invoice.

Print

Part Numbers: Select if you

wish to print these on your invoice

Print

Full Retail Price: Select

if you wish to print these on your invoice

Prompt

For Number Of Copies: If

you wish to be prompted to print more than one copy of a form select the

prompt

Bar

Colour: Auto Easy allows

you to customise the invoice header bar colour, to select point and click

on the colour field and select from the displayed grid.

Prompt

For Printer When Printing: Selecting

this option will allow the operator to select another printer other than

the default.

Receipt

Printer: Auto Easy allows

you to attach a slip printer to a designated com port, select the down

arrow to the right of the receipt printer field, point and click on your

selection. A print job will be sent to the slip printer when a cash sale

is performed or a payment is received. To initialise these functions point

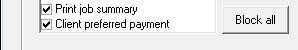

and click in the appropriate check box at the bottom of the printer settings

form.

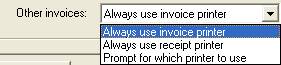

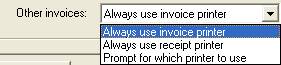

|

Other

Invoices: It is possible

to print invoice to the receipt printer – no work description or vehicle

faults are printed when selecting this option. Select from the option

your preference. |

|

Once your site is created and your printer settings

have been customised you need to configure the site settings, the following

notes guide you through the process

Till Draw

Auto Easy Ultimate allows you to attach a serial

till draw that needs to be connected to a coms port on the local machine

(if you are running a LAN). To set-up a till draw perform the following:

|

Connect a serial till draw to a coms port on your

computer

1) Open settings from the file menu, select printer

settings

2) Point and click in the enable till check box

3) Select the port your till draw is connected

to from the menu

4) Save the settings with OK (F12)

5) Test the till draw operation by pressing the

F9 key |

|

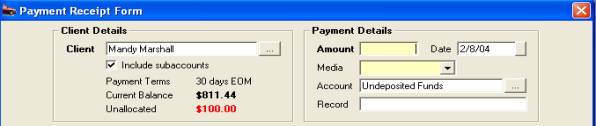

Till

Draw, Opening: When the till

function is enabled a second OK function is added to the payment receipt

form, if you wish to open the till draw as you finalise a sale select

the till draw icon or press the F9 key.

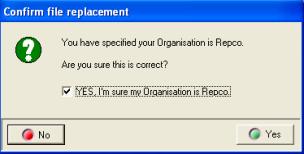

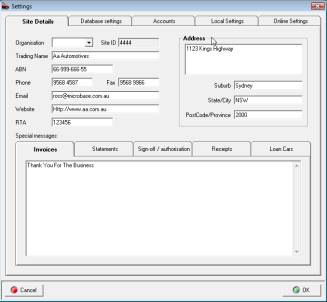

Site Setup Procedure

Settings,

Accessing:

You will need to set your

site preferences before using the program, from the opening screen select

file / settings. The display is tabulated with six choices:

v

Site Details

v

Database Settings

v

Accounts

v

Local Settings

v

Online Settings

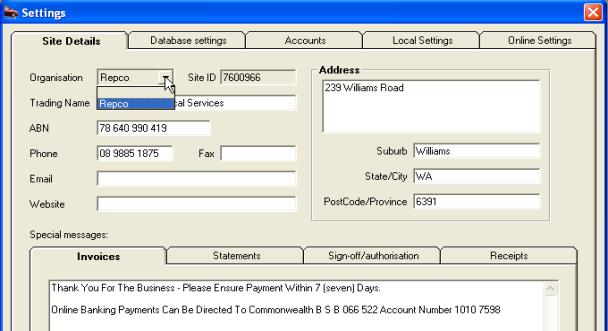

Site Details

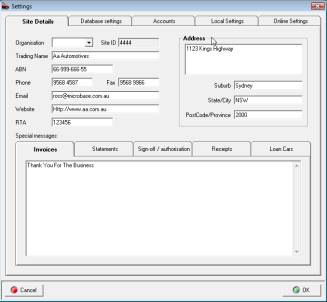

|

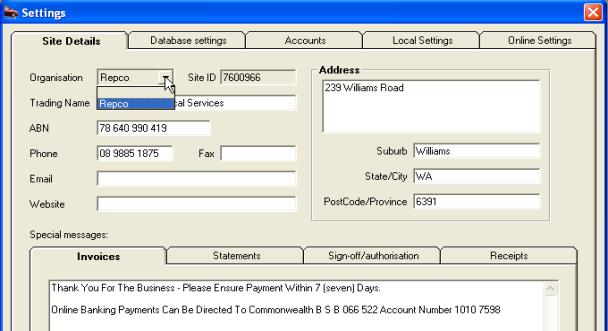

Fig 2.04 Settings

/ Site Details |

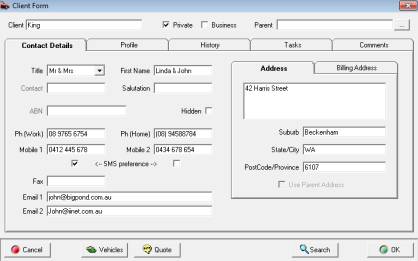

Trading

Details: Enter your trading

details including email address into the fields provided. Enter your suburb

and press the enter key, your postcode and state will automatically be

inserted into the appropriate fields.

RTA

#: If you have a registration

number that needs to be printed on the invoice enter details into the

RTA field.

Text

Messages: Auto Easy allows

you to enter four text messages that are printed at the bottom of the

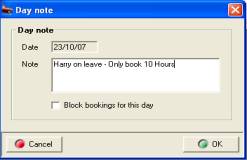

invoice, client statement, sign off / authorisation and receipts. A fifth

option tab is available to enter terms and conditions for the loan car

contractTo enter messages click on the tab type your text into the appropriate

field. On printing the text lines are automatically centered on the form.

Save your changes by selecting OK (F12).

|

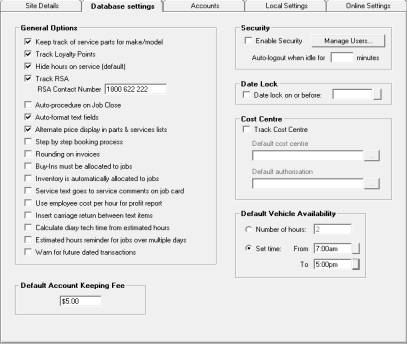

Database Settings

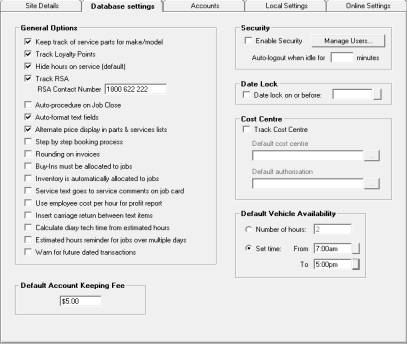

|

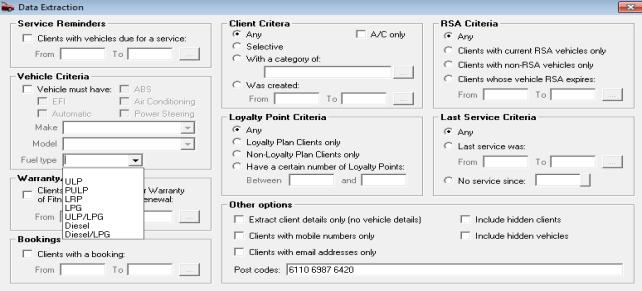

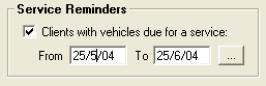

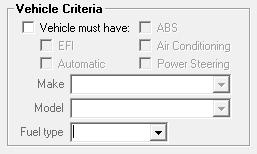

Fig 2.05 Program Options |

Customising:

Selecting Database

Settings allow you to customise various features of Auto Easy by pointing

and clicking in the checkbox next to listed feature.

The selections are categorized into the following:

General Options

Cost Centre

Security

Date Lock

The notes in this section will describe the use

of each feature.

|

General Options

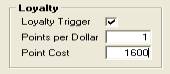

Keep

Track OF FP Service Parts For Make/Model: Will

display parts on the invoice based on make / model and service for previously

performed services

Track

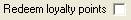

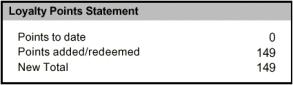

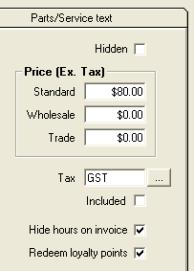

Loyalty Points:

If you are operating a loyalty program mouse click in the appropriate

field. When using the loyalty program member’s invoices display a statement

of points to date.

Hide

Hours On Service (Default)

– When this option is selected the hours for each service are not printed

on the clients invoice.

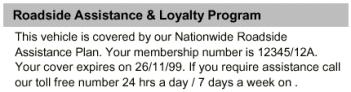

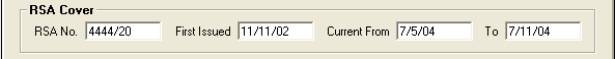

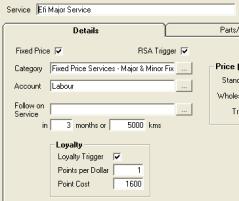

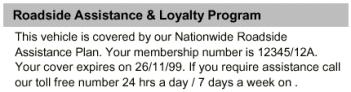

Track

RSA: This feature allows

you to issue roadside assistance to your clients if you intend using support

services.

RSA

Contact Number: If you are

issuing roadside assistance to your client base type in the contact number,

which will be printed on the invoice. If you are using support services

the number will be supplied to you. RSA issue details are printed on the

invoice if this feature is selected.

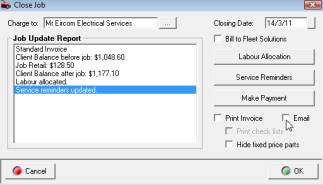

Auto

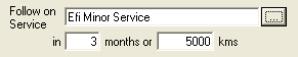

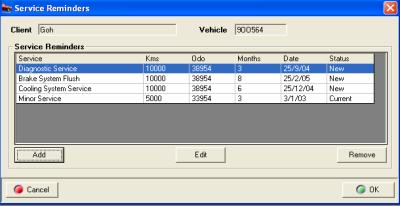

Procedure On Job Close: If

selected will automatically lead the operator through Hours allocation

& Service Reminders. Service reminders and labour allocation can be

selected manually if required.

Auto-

Format Text: Capitalises

the first letter of each word regardless of the cap locks setting.

Alternative

Price Display In Parts & Services Lists: Displays MRRP, retail, wholesale, trade

and recommended retail prices including GST.

Step

By Step Booking Process: Initialises

the automated booking process from the diary screen.

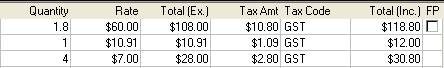

Rounding

On Invoices: Selecting rounding on invoice, rounds

the invoice value to the nearest zero or five cents. The adjustment is

posted to an other income account; it is displayed in the financial summary

of the job card and printed on the final invoice

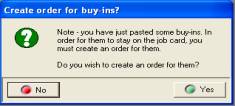

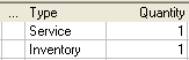

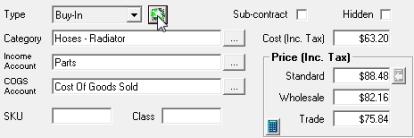

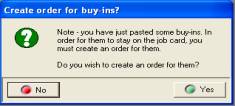

Buy-

Ins Must Be Allocated To Jobs: Selection

ensures that all buy-ins (items specifically for jobs) are allocated to

an open job card. When this option is selected it will no longer be possible

to enter buy-ins onto a supplier invoice without a job allocation.

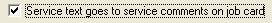

Service

Text Goes To Service Comments On Job Card:

This feature allows you to further customise your invoice layout by placing

text attached to services into the service comments field so it is printed

below the service rather than in the work done field.

Use

Employee Cost Per Hour For Profit Report: Auto Easy automatically calculates the cost

per hour for technicians by dividing the total value of hours sold for

the past 90 days into the total payroll for technicians over the same

period. If you wish to overwrite this feature select this option it is

now possible to enter a manually calculated labour cost per hour against

each employee from the employee form, this value is applied when running

a profit report from the job card.

Insert

Carriage Return Between Text Lines:

Selecting this option will place a carriage return between the lines of

text when selections are made from the work done or vehicle faults data.

Calculate

Diary Tech Time From Estimated Hours:

Select this option if you wish the diary hours available table to calculate

from estimated time rather than technicians allocated times.

Estimated

Hours Reminder For Jobs Over Multiple Days: Selection will remind the operator to edit

estimated job times for the day based on jobs carried forward from previous

periods

Warn

For Future Dated Transactions: If

this option is set to true when a future dated transaction is entered

you will be prompted whether you wish to continue or not,.

|

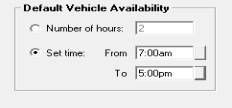

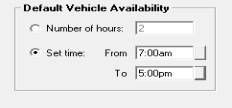

Adjusting

Default Booking Hours – To

adjust the default booking hours (set at 2) open File settings select

the database settings tab. From the bottom of the form select the method

you wish to use as a default booking time. There are two options hours

or time, save your changes by selecting OK (F12) from settings.

|

|

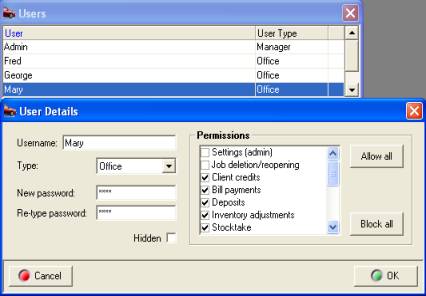

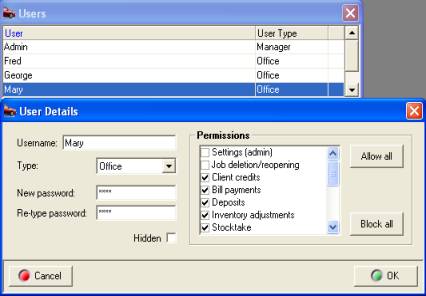

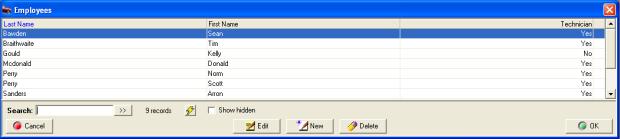

Security

Security

Overview: Auto

Easy Ultimate allows you to set different access permissions for each

user; on first installation the security feature is inactive. This feature

is used in two ways.

Firstly, as a way of securing sensitive information

ie: you may not wish your technicians to be able to view your chart of

accounts, banking functions or financial reports. You would however give

permission to your office staff to perform bill payments, make deposits

and create client credits. Auto Easy allows you to set the permissions

for each employee, who is then assigned a unique log in and password.

When operating on a network it is possible to have different users logged

onto the terminals with only the permissions for the terminal operator

being applied.

Secondly, as a management tool for the in built task

manager, using security allows you to set-up appointments and tasks by

user or user group. When logged in a user will only be able to view that

individual’s appointments and tasks. Security permissions also allow you

to establish whether the user is able to enter tasks or appointments for

other users.

If you wish to use the security function it

will have to be enabled from the configuration screen.

|

|

Security,

Enabling:

Point and click on the enable option positioned above the manage users

button. Next you need to enter the user’s name (this will be their unique

log in), set the user type, establish the permissions and enter a password.

The password can be in text, numbers or a combination; the password field

is case sensitive so if you enter a letter in capitals it must be typed

in the same way for the user to be logged on. Note that when entering

your password you are asked to confirm by re-typing, if the combination

does not match the original entry a message is displayed. Simply re-key

correctly

|

|

|

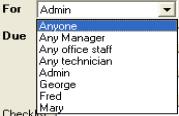

To select the user type point and click on the down

arrow situated on the right hand side of the type field. There are three

user types Manager – Usually would have full access, Office – Access to

limited administration functions, Technician – Access to jobs and the

accompanying functions only with no access to administrative tasks

|

|

|

The allow all and block all function is a quick way

to set or secure access to all functions, you can use this as a short

cut, then simply edit the selections you wish to change. |

|

|

|

|

|

|

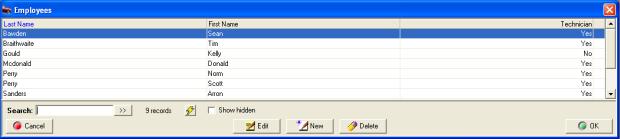

Fig 2.06 Setting User Defaults |

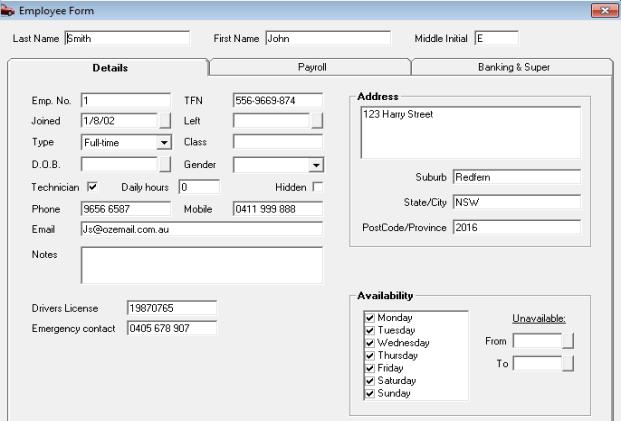

Security,

User Default: To

setup a new user select manage users from the configuration screen, select

new, the user details form is displayed. Enter the user name, select the

user type, enter the password (remember this is case sensitive), confirm

by retyping in the re-type password field.

Next point and click on each function you wish to

give the user access to. Remember that if you want this user to be able

to add appointments and tasks for other users tick the option at the bottom

of the list.

|

Note: It is important that you retain your password

in a SAFE place as loss can cause operational problems. It is also suggested

that you limit your password to a maximum of 6 characters so it is easy

to remember.

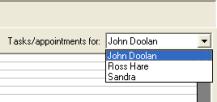

Security,

Log On:

Once security is set you

will need to log on to use the program, on start up a log in message is

displayed, type the user name or select from the drop down list, enter

the password and press enter or select OK.

|

Fig 2.07 Log In Display |

If a user attempts to access functions that have

not been selected in the security profile an access denied message is

displayed. It is however possible to change a users access at anytime

by selecting File / Settings / Configuration / Manage Users. It is of

course suggested that only the manager has access to the setting option

to prevent unauthorized use of the program.

|

|

Fig 2.08Log Out |

Security,

Log Out:

To log out of Auto Easy

select file / logout, this procedure will log you out of the program displaying

the log in message for the next user to sign back in. If security is a

concern it is suggested that you log out whenever you leave the terminal

and log back in when you return.

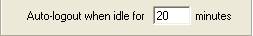

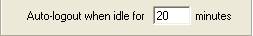

Auto

Log Out When Idle: This options

allows the operator to set an auto log out period when the terminal is

inactive. Enter the minute value into the field provided, once this period

is exceeded you will be required to log back into the system.

|

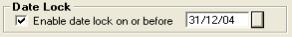

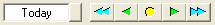

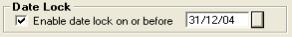

Date

Lock

Provides the operator with the ability to lock

records prior to a nominated date, to enable point and click in the check

box then select the button to the right of the date field, from the calendar

select the lock date by double clicking in the grid, save your settings,

you will not be able to edit any records prior to the selected date. It

is however possible to change your settings or disable the feature at

anytime

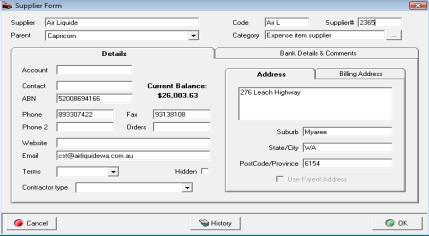

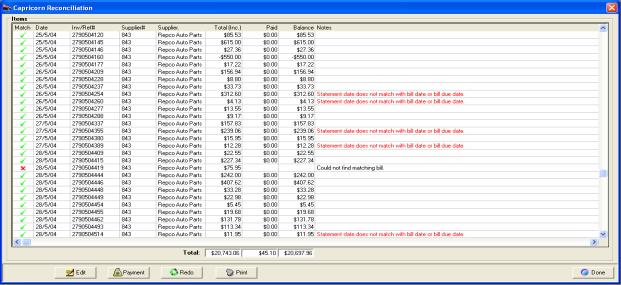

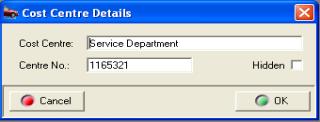

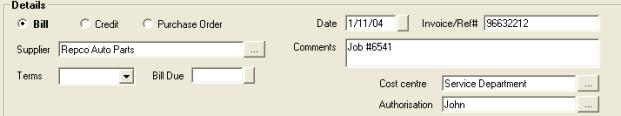

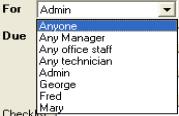

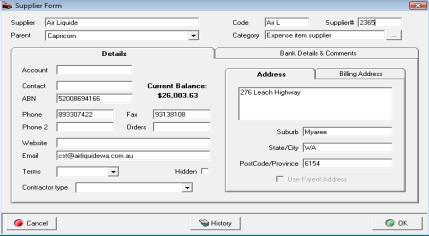

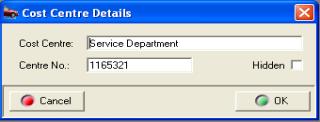

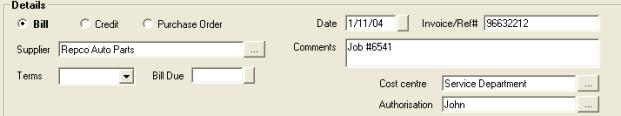

Cost Centre

Track

Cost Centre: Allows you

to select a cost center and default authorisation for purchases and track

via the purchase transaction report. To set-up cost centres you will need

to add an entry to the list and also have at least one user setup.

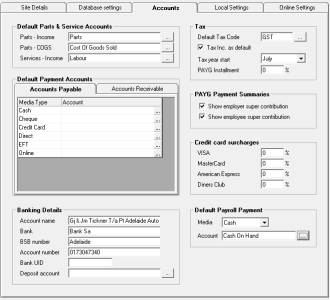

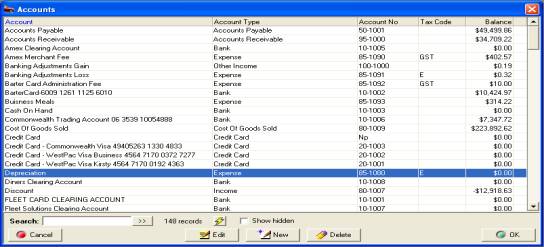

Accounts

|

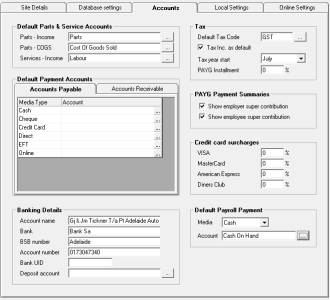

Fig 2.09 Accounts |

Customising:

The accounts tab allows

you to setup various accounting functions within Auto Easy; these are

categorized in the following way:

Default Parts & Service Accounts

Default Payment Accounts

Banking Details

Tax

Credit Card Surcharges

Default Payroll Payment

The notes below describe the use of the options

available |

Default Parts & Service Accounts

Default

Accounts: Parts – Income,

Parts – COGS, Services – Income, select the accounts you wish to apply

as the default. Clicking on the button to the right of the field will

display the chart of accounts, highlight the record you wish display by

selecting OK (F12) from the bottom of the account list.

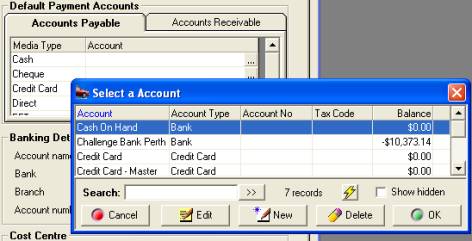

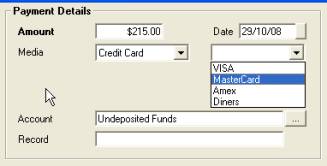

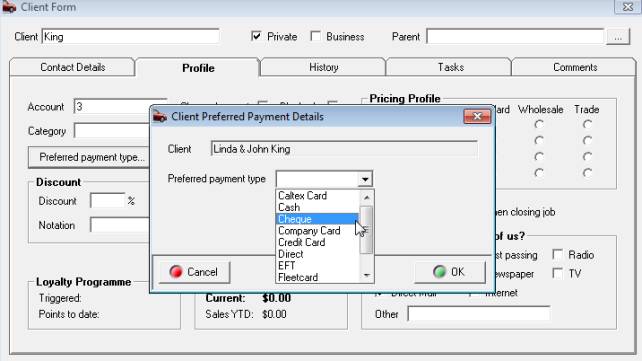

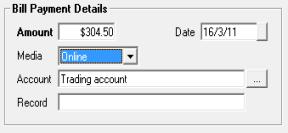

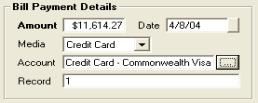

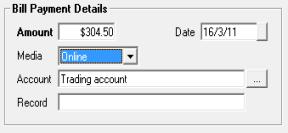

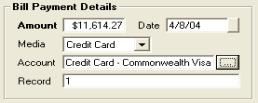

Default Payment Accounts

Auto Easy allows you to attach default accounts to

receipt and payment media selections. You may wish for all your cash and

cheque receipts to be posted to undeposited funds, EFT and credit cards

to a clearing account. Accounts can also be selected for payment types

ie: Cheques can be attached to your main trading account, cash to cash

on hand or undeposited funds.

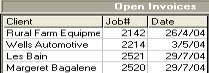

To setup select Accounts Payable or Accounts Receivable

tab, point and click on the button to the right of the account field a

list of your payment / receipt accounts is displayed. Select the account

you wish the transaction to be posted to finalise with OK (F12), the name

of the account is displayed in the account column.

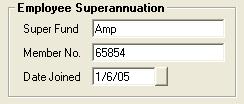

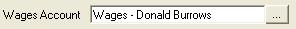

Default Payroll Payment: To record a default wage account open settings

from the file menu click on the accounts tab. Select the payment media

and account from the drop down menu. Save your settings by exiting via

OK or F12

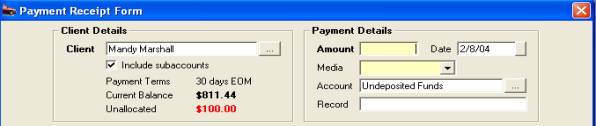

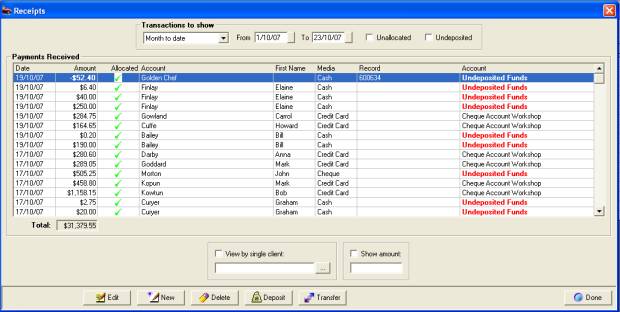

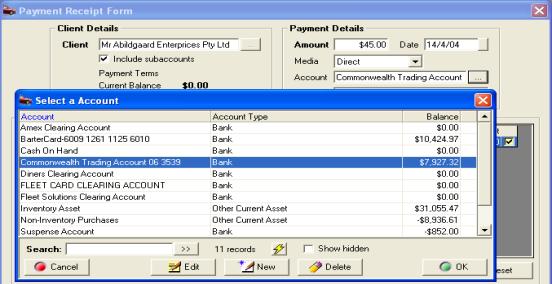

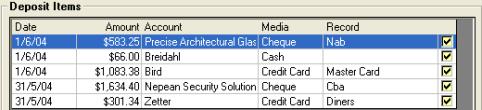

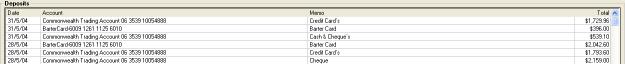

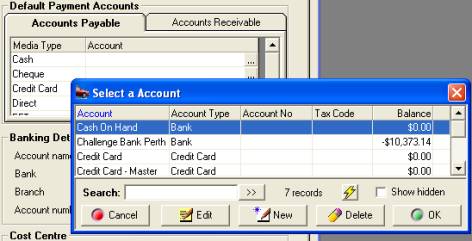

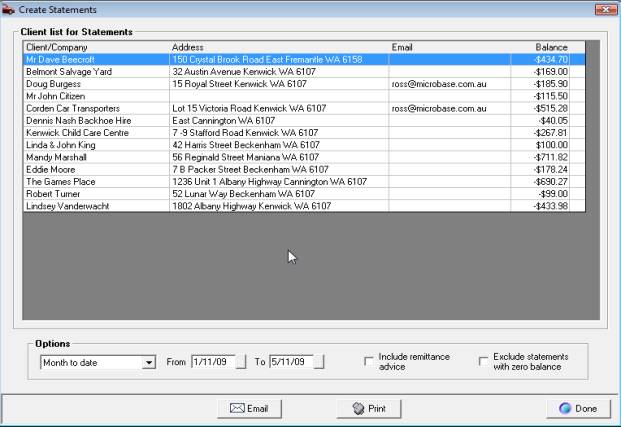

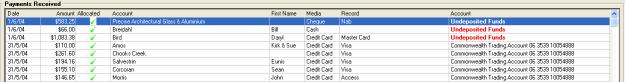

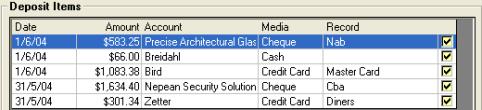

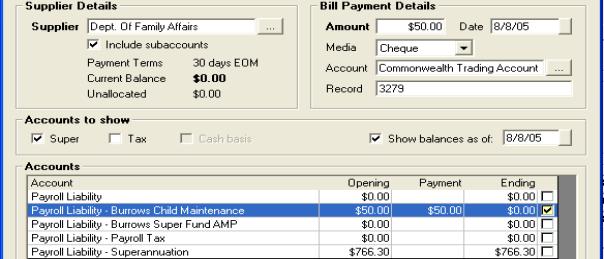

Fig

2.10 Default Payment Accounts

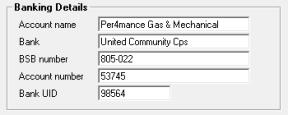

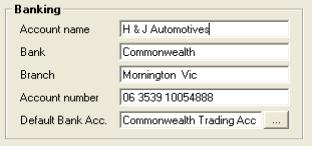

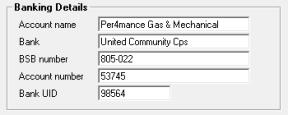

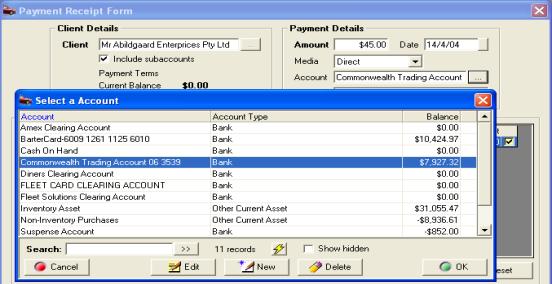

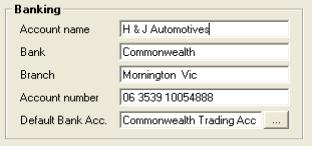

Banking

Options allow you to set up your bank details to

print on deposit slips. Nominate a default bank account (this is normally

your main trading account).

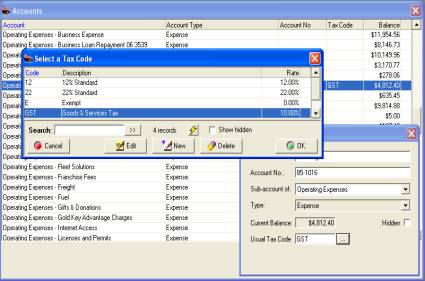

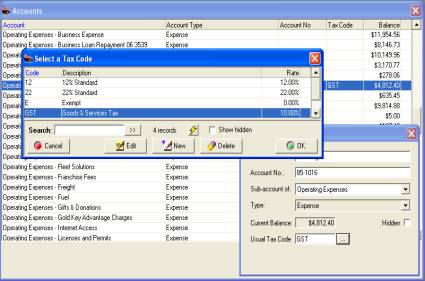

Tax

Auto Easy Ultimate allows you to store multiple tax

codes, which can include varying rates of tax or exemptions. You can also

select a code to be your default in most cases this will be GST.

Tax

Codes, Selecting: To

view tax codes or select a new default code mouse click on the button

to the right of the default tax code field:

|

Fig 2.11 Selecting or creating a new tax code |

Auto Easy allows you to set up multiple tax codes

that apply varying rates of tax to specified items. Highlight the tax

code you wish to make the default and select OK the code will display

in the default tax code field. The default CAP Tax code when selected

will post purchases to G10 – Capital purchases on your BAS. |

Tax

Codes, Creating: Select

new from the bottom of the display the tax details display consists of

the following fields:

v

Tax Code: Insert a unique code for the tax

v

Rate: Record the rate of tax to two decimal places

(do not enter a % sign, this inserts automatically)

v

Description: Include a description for the tax ie: Wholesale,

GST, Exempt

v

Account: Allows you to allocate the tax to a sub

account of tax payable, you may wish to separate the various taxes that

apply to your business. If you wish to apply a tax in this way you will

need to set up the sub account in the chart of accounts.

|

Fig 2.12 Creating tax codes |

You can apply different tax codes to parts, services

and expenses. The taxes can be allocated to one account ie: Tax Payable

/ GST or you can create individual tax accounts. Auto Easy gives you the

option to view values over a date range by tax code.

This option is helpful if you handle the liability

differently to your default tax code. An example is private vehicle use

that may not be tax deductible any expenses that you apply to a unique

tax code can easily be tracked |

Tax

Included As Default: Select

this option if you wish the cost and retail prices to default to tax included,

leave blank if you wish the default to be ex. Tax.

Tax

Year Start: Enter the start

month of your tax year, if you are starting to use Auto Easy Ultimate

during the tax year you still need to enter the tax start month in this

field. If this is not entered correctly it will impact on your financial

reports.

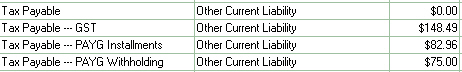

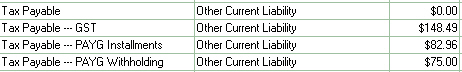

PAYG

Installments: If you are

liable for PAYGI enter the % rate into this field, PAYGI is calculated

on sales excluding GST and is visible as a total in Tax Payable / PAYG

Installments posting in the chart of accounts.

Credit

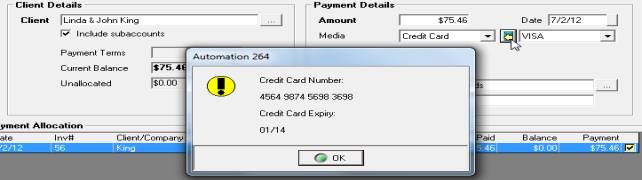

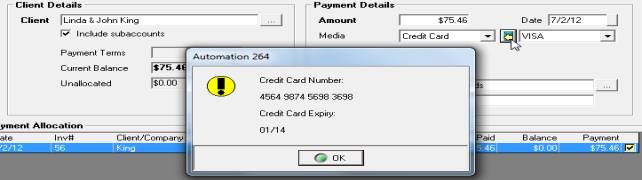

Card Surcharge

|

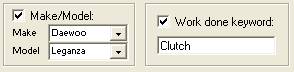

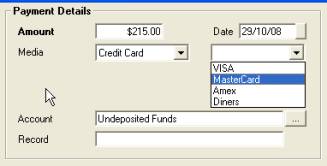

|

Auto Easy allows you to setup different percentage

surcharges for four credit card types. When a value is entered and you

choose to process a client payment via credit card a selection field is

displayed, simply select the credit card type and the percentage is added

to the total payment when printing a receipt – Note the receipt is titled

tax invoice for taxation purposes. The surcharge is also recorded in the

payments section of the client card. |

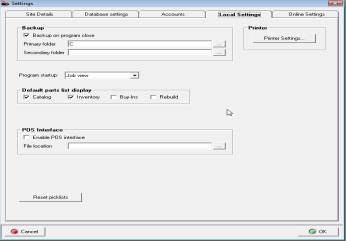

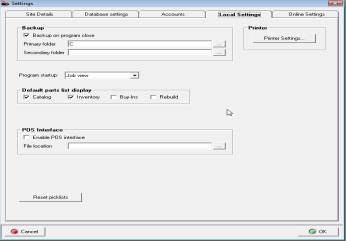

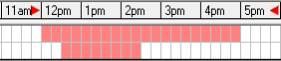

Local Settings

|

Fig 2.13 Settings / Local Settings |

Customising:

Local settings allows for

further customisation

To the following functions:

Backup

Printer

Default Parts List Display

Diary Job Screen Sorting

Reset Picklists

The following notes describe how set each function

|

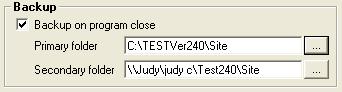

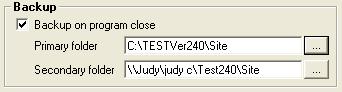

Back-Up On Program Closes

The option allows you to select two drives for the

backup purposes. This is usually a directory on the hard drive plus a

removable drive ie: USB Flash Disk or CD ROM. To chose the backup locations

select the button to the right of the field; from the navigation window

select the drive you wish to write to and click on OK (F12). Perform the

same for the second location, when backing up to removable media you must

ensure the drive is available before exiting the program.

Printer

Settings

Selecting this option will open the printer settings

– see printer settings for details.

Default

Parts Display

Allows you to select which part type you wish to

set as a default

Diary

Screen Job Sorting

Select whether you wish the order of jobs on the

diary screen to be by job number or client.

POS Interface

Genesis in conjunction with Computer Vision have

developed a basic link to the Quick Fuel POS system, if you have this

application installed and wish to link with Auto Easy select the checkbox

and search for the Quick Fuel company file by clicking on the button to

the right of the file location field, this action will allow you to navigate

your PC.

Reset Picklists

Option allows you to set you list configuration to

the optimum for your chosen resolution – please not you will have to exit

the program and re-enter for the settings to be visible

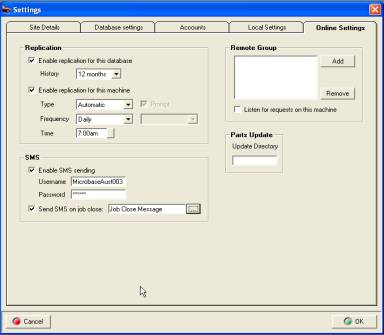

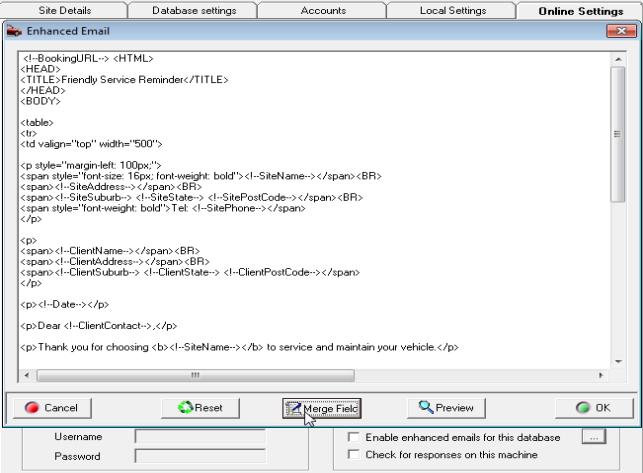

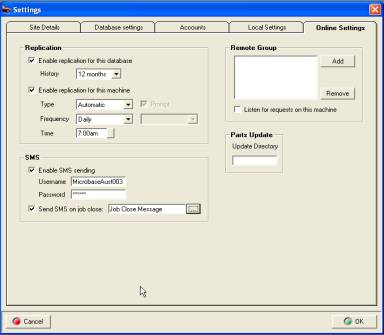

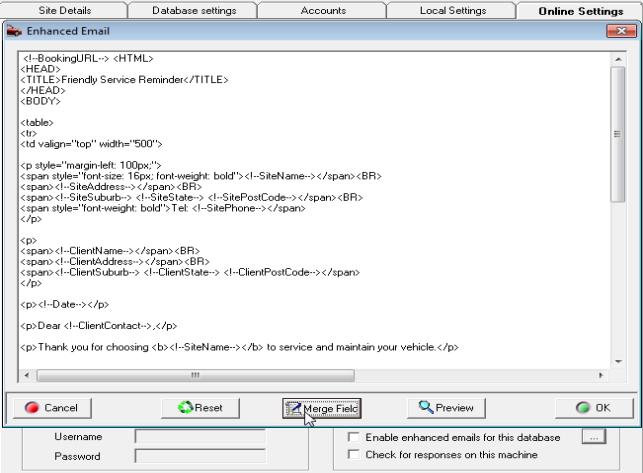

Online Settings

Fig 2.14 Online Settings

|

Customising: The online settings option is configured in the following way:

Replication

SMS

Remote Group

Parts Update

The following notes describe how to use each function.

|

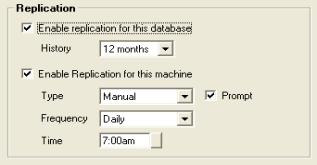

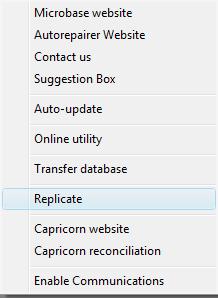

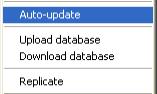

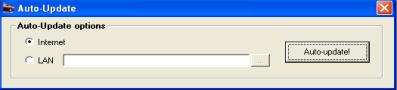

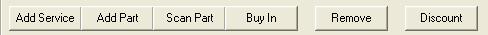

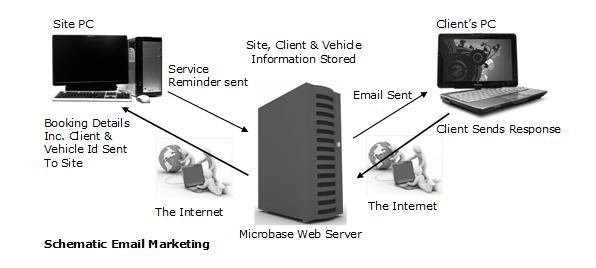

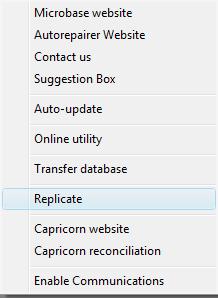

Replication

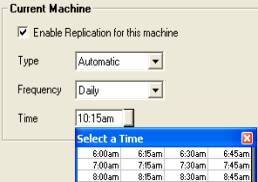

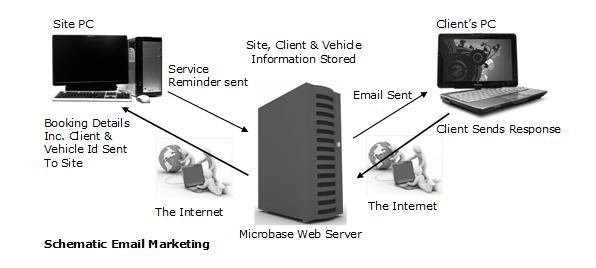

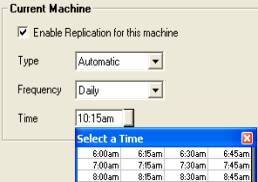

Overview: Replication is used to transfer data to a central server for data analysis (organisation dependant) and or central database marketing (generation of client communications & roadside assistance). Before data can be transferred the replication process has to be set, plus you will also need the machine to have access to the Internet via dial-up or broadband. You will also need to set your browser to always dial your default ISP (For dial up connections only).

Replication, Settings: Select the replication tab at the top of the display – point and click in the enable replication for this database option.

|

Next you need to choose whether you wish to send 12 or 6 months data (6 months is sufficient unless notified by Genesis). You will now be able to select the 6 month option by pointing and clicking on the arrow to the right of the history field.

|

|

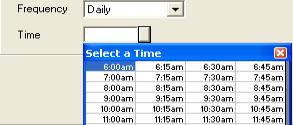

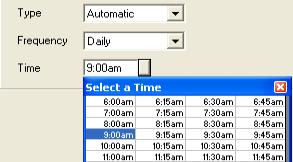

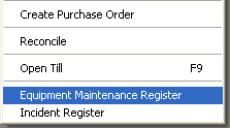

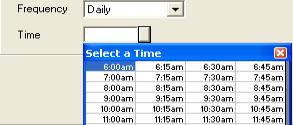

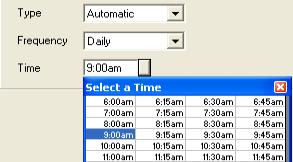

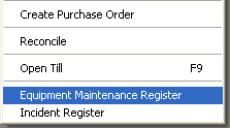

The next step is to select enable replication for this machine (For a site running a network this option should only be selected on one machine which has access to the internet). This will display the auto / manual options, frequency and replication time. It is suggested that the replication is performed on a daily basis, select a time which is suitable if operating on broadband select Automatic from the type field, for dial up users select manual, this option will display a message at the appropriate time reminding you to replicate – to initialize select yes from the message box. Select weekly or daily from the frequency field, time can be chosen from the table by pointing and double clicking. Save your settings

|

Replication, The First Connection: The first replication for sites that have 6 months of data will take a considerable time (faster on broadband) do not be alarmed by this as it is a “one off” process, once the first replication has completed the process should take no longer that a couple of minutes a day (dial up connections faster on broadband).

|

It is suggested that you manually initiate your first replication by selecting the on-line option from the top of your screen, point and click on the replication option. This will connect you to the server and start to replicate your records (10 passes in total). You will see a progress monitor in the form of a pink bar as the data is transferred.

On completion a message box (for dial-up users) will prompt to disconnect from the internet, select Yes if you wish to work off line. No message is displayed if you are using broadband.

|

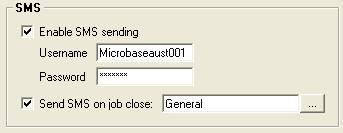

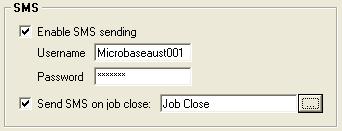

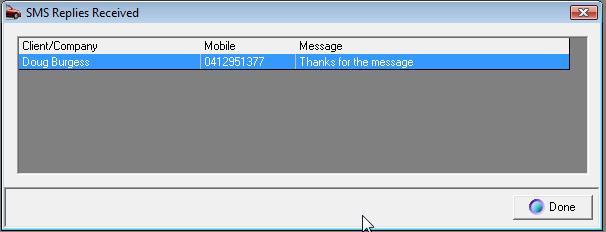

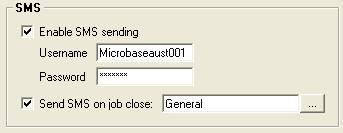

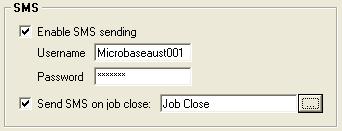

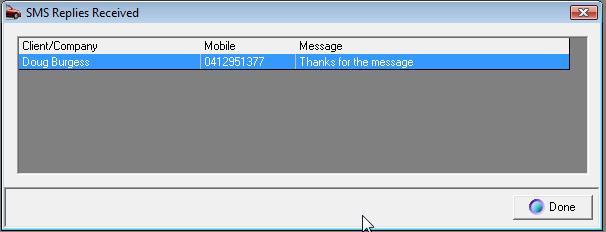

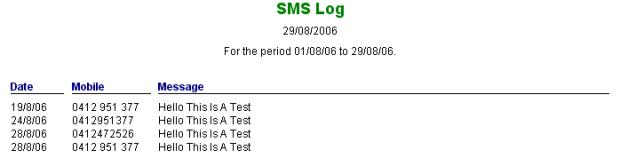

SMS Messaging

Auto Easy allows the user to send SMS messages to

single or multiple clients, for this feature to work you must have an

internet connection plus an account and password from Genesis Australasia.

Enter the account details into the fields provided.

|

|

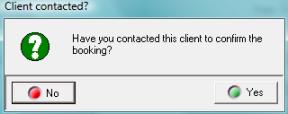

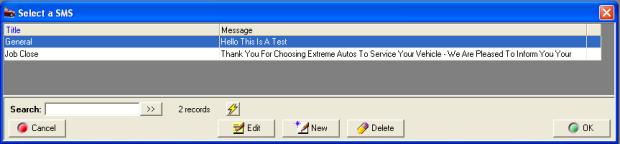

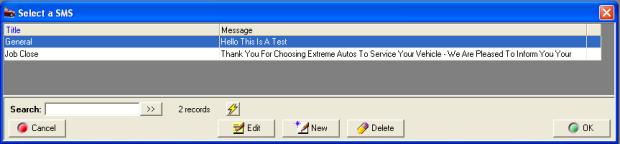

If you wish to send a default text message to your

clients on job card close select the Send SMS on job close option, point

and click on the button to the right of the field, a list of SMS messages

is displayed, select the one you wish to send and confirm by selecting

the OK (F12) option at the bottom of the list. |

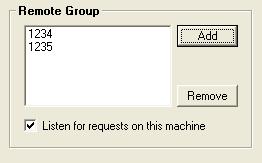

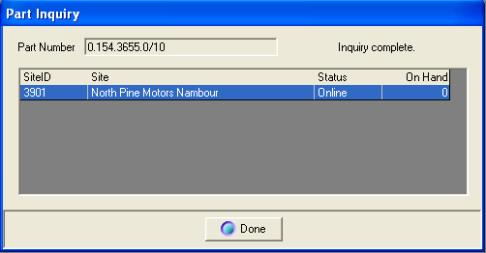

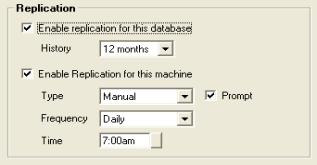

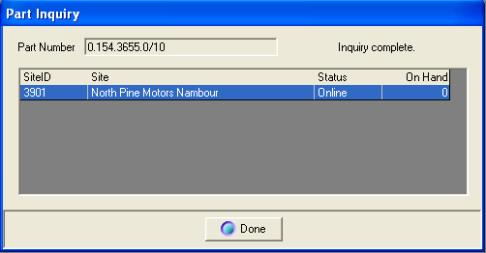

Remote Sites Parts Inquiry

|

The right hand side of the online screen allows the operator to setup single or multiple sites to contact to check stock on hand.

Before adding sites ensure that the remote and local site/s have replicated with the Genesis server. This only needs to be performed once to record the site id., if you do not intend to send any further data to the server turn the replication feature off after the initial replication.

Select add to enter a new site, type the site id. Into the field provided, save with OK (F12). Repeat the process for any other sites in the group. o finalise the setting select listen for requests on this machine, only one machine that has access to the internet on the network needs to have this option selected. Save your settings with OK (F12)

|

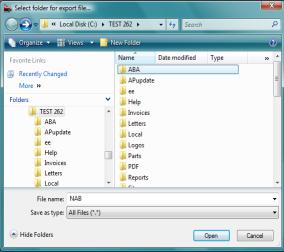

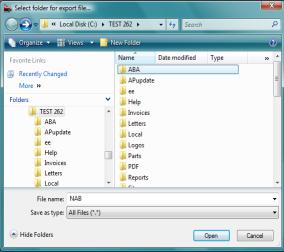

Parts

Update

|

|

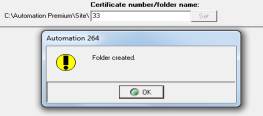

Enter the folder name for data uploads and price

file updates, the software provider will assist you with these settings.

|

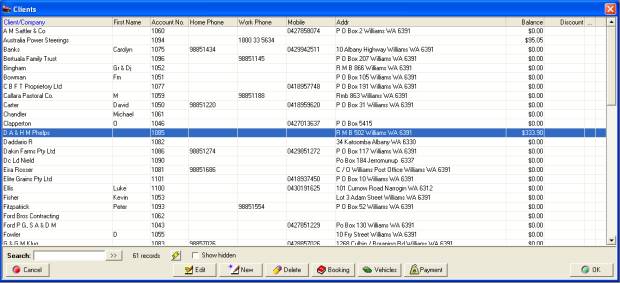

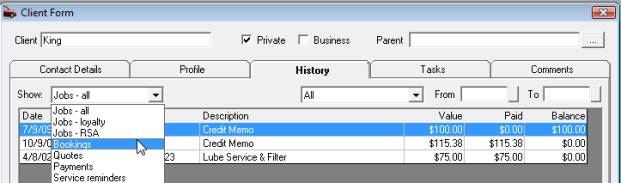

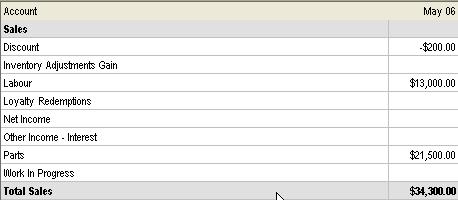

Accounting

System Overview

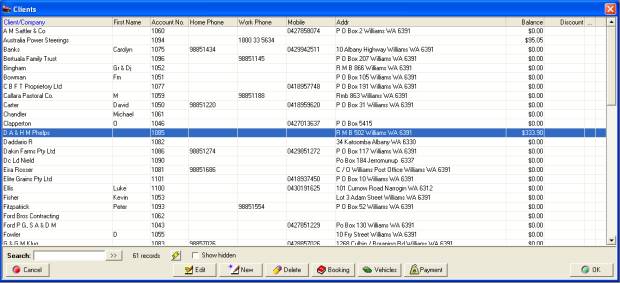

One of the main advantages to using Auto Easy is

that as you create invoices, write cheques, and produce purchases orders;

Auto Easy is literally you doing your bookkeeping. To make it easy to

perform regular tasks, Auto Easy saves information on various lists so

you don’t have to retype it each time you need it. For example, in the

client list, you can save addresses, phone numbers, and payment terms

that apply to a customer.

It is not essential for the operator to have a full

understanding of the accounting processes as Auto Easy is programmed to

allocate certain transactions to specified accounts, an example is parts

and labour these are linked to an income account so there is no need to

set the posting account. Likewise inventory purchases are posted to accounts

payable and inventory asset accounts. It is however necessary for you

to customise your chart of accounts to allow for specific postings. A

standard chart of accounts is included in the data set of Auto Easy, the

chart of accounts can however be changed to suit an individual business.

Accounts can be deleted, edited or added.

You get out only what you put in

If you want to see detail on reports, be sure to

track it somewhere in Auto Easy. For example, if Harry needs to know how

his yearly travel expenses break down by airfare, lodging, and meals,

first he needs to subdivide his expense account for travel expenses into

three sub-accounts. Then he needs to break down his expenses each time

he enters them into Auto Easy.

What you shouldn’t try to track in Auto Easy

There are some things that you should not try to

track in Auto Easy:

v

Personal finances: For tax purposes, it’s usually best to

keep your business income and expenses completely separate from your personal

income and expenses. (If you still want to track personal finances in

Auto Easy, set up a separate site file for them.)

v

Investments in shares

or trusts: If the business

owns these investments, you can track the cost basis as an asset. However,

Auto Easy doesn’t have the investment tracking.

v

Details that are not

specifically related to your business

accounting: For example, John needs to track when subscriptions

expire so he can send reminder notices.

Chart

Of Accounts

You can fine-tune your chart of accounts at any

time by doing the following:

v

Add new accounts or sub-accounts.

You can add sub-accounts to balance sheet accounts (for example, fixed

asset accounts) as well as to income and expense accounts.

v

Delete accounts that have

no transaction history

v

Change the name of an existing

account.

v

Enter an opening balance

for a new account

v

Arrange accounts in order

of account type or name

v

Make one existing account

the sub-account of another

Understanding

The Account Types: Before customising

your accounts it is important to understand what each account type represents:

|

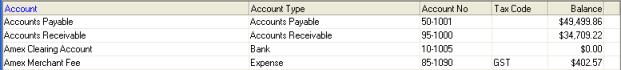

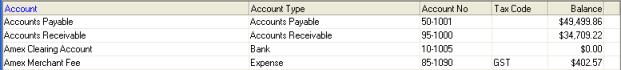

Account Type |

Purpose |

Examples |

|

Accounts Payable |

What you owe suppliers and service providers |

Job parts and inventory purchases, what you owe

for services rendered ie: accounting, window cleaning and consumables |

|

Account Receivable |

What your clients owe you |

Balance owing for jobs performed or parts and

services provided |

|

Bank |

Cash you have available |

Relates to your trading account or cash on hand |

|

Cost Of Goods Sold (COGS) |

The cost of parts or services that you have on

sold |

Includes parts taken from inventory, catalogue

items or parts and services purchased for a specific job |

|

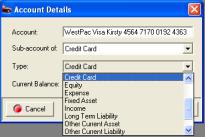

Credit Card |

Allows you track the transactions logged on your

company credit card |

Purchases made for parts and services provided

to your business |

|

Equity |

The net worth of the business |

Auto Easy has 2 standard equity accounts – retained

earnings and opening balance equity. |

|

Expense |

Expenses you incur to run your business |

Examples are bank fees, electricity, rent and

vehicle expenses |

|

Fixed Asset |

Items of plant or buildings your business owns |

Tools, office equipment, shelving or the value

of a property from which you operate your business |

|

Income |

Parts and labour you have sold |

Items and services sold on cash, charge or job

invoices |

|

Other Current Asset |

Other assets that are not registered as a standard

asset |

Examples include stocks & shares, loans made

to other companies or individuals |

|

Other Current Liability |

Liabilities other than purchases from suppliers

and service providers |

Includes tax owing and loans made to your business

|

|

Long Term Liabilities |

Liabilities, such as loans |

Includes non-current liabilities |

|

Other Expense |

Any expense that you decide not to allocate as

an expense |

Examples may include personal expenditure |

|

Other Income |

Income that is generated from activity outside

of selling parts and labour |

Can include items such as rent or interest received

|

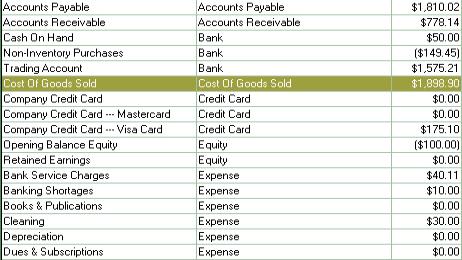

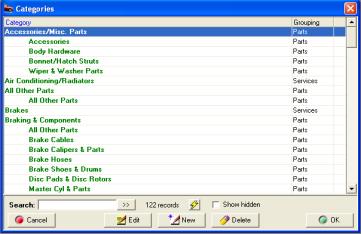

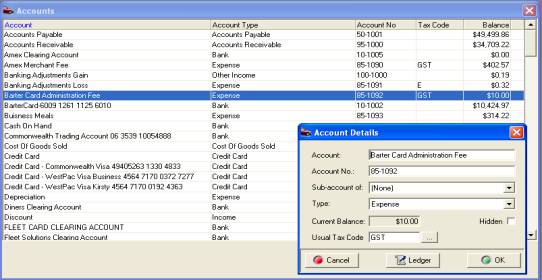

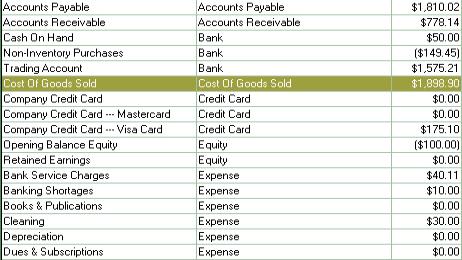

Chart

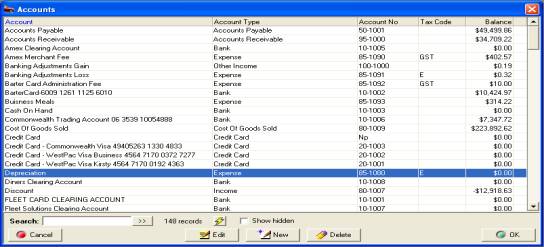

Of Accounts, Accessing: From

the top menu bar select lists / chart of accounts you can now view the

standard chart of accounts and add, edit or delete (only non-system accounts

and accounts that have no transactions applied).

Fig 3.01 Chart Of Accounts

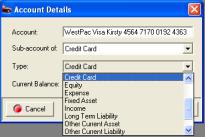

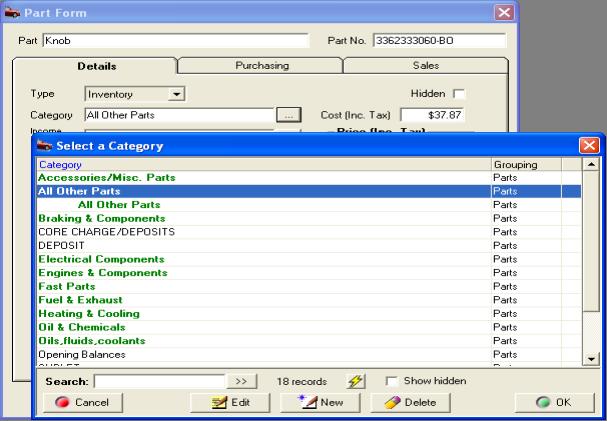

Chart

Of Accounts, Creating New Accounts: From

the bottom of the accounts listing select new, this action opens the account

details form enter the name of the account ie: Office equipment, account

number (if you use these as references). It is possible to group account

numbers by entering a dash in the record. If the account is a non-posting

account (all master accounts should be set as Non- posting) enter NP or

type Non-Posting into the account number field. Do not select non-posting

accounts when processing transactions.

Fig3.02 Creating A New Account

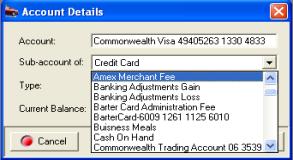

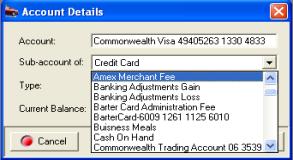

Chart

Of Accounts, Creating Sub Accounts:

If you wish to attach an account to a master select the arrow to the right

of the sub-account field. A list of accounts is displayed, highlight the

account you require and double mouse click. The account will appear in

your chart of accounts as a sub account. Ie Depreciation -- Hoist

You may want to use sub-accounts for two reasons:

v

You want a further breakdown

of amounts for an existing account. To accomplish this, set up sub-accounts

of the existing account. From now on, use the sub-accounts instead of

the parent account. (You may want to edit earlier transactions so the

breakdown shows up on reports covering a period before today.) For example,

suppose you have an Insurance expense. You add sub-accounts for building,

equipment and personal

v

You already have related

accounts that you want to subtotal on reports (Or you may want to find

them more easily). You set up a new parent account and then make the related

accounts sub-accounts of the new parent.

Chart

Of Accounts, Entering Opening Balances: Before

entering your opening balances it is suggested you give some thought to

how you want your chart of accounts to work for your business. If you

require detailed reporting on any account you can set up sub accounts

under a “parent” ie: you may wish to track the individual expenses related

to running a motor vehicle in this situation you can create a parent account

titled workshop utility and attach sub accounts to the “parent” which

can include Fuel & Oil, servicing, insurance and lease payments. Using

this method will allow you to report on each component that makes up the

total running expenses of the workshop utility.

You may also wish to create individual accounts

under fixed assets such as hand tools, hoist, computer system etc. Give

some thought to items such a other liabilities these can include loans

and taxes owing.

If you receive income from any other source that

selling parts and labour set up specific accounts under other income,

maybe you collect rent from a tenant if so this should be allocated to

other income into an account titled rent.

Once you are satisfied with the structure of your

chart of accounts you need to enter the opening balances into Auto Easy.

The standard chart of accounts records a zero balance on all accounts,

it is possible to add an opening balance to an account posting if it falls

into the following:

§

It is a new account

§

A standard account that

has a zero balance

An opening balance can only be entered once, however

if you make a mistake you can adjust with a journal or funds transfer

entry.

Default

Tax Code: Selecting the button

to the right of this field will display your tax code list highlight the

record you wish to attach to the account and select OK (F12) to enter.

You can only add tax codes to expense and fixed asset accounts.

When posting to an account with a default tax code the system checks the

code against the line item, if this does not match a warning message is

displayed.

Tracking Equity Accounts

Your business’s equity comes from two sources:

v

Money invested in your company

(capital investments)

v

Profits of your company

Of course, the owner can also take money out of

the business. Such withdrawals, called owner’s drawings, reduce the company

equity. Auto Easy sets up two equity accounts automatically:

Opening

Balance Equity:

For every balance sheet account you set up with an opening balance, Auto

Easy records the amount of the opening balance in the Opening Balance

Equity account. (Asset account opening balances increase the equity; liability

account opening balances decrease the equity.)

Retained

Earnings:

If you have data for more than one financial year. The Auto Easy balance

sheet has a balance for the Retained Earnings account equal to the net

profit from prior financial years. The balance for the Retained Earnings

account does not display on the chart of accounts.

Some people like to track owner investments, owner’s

drawings, and retained earnings prior to the Auto Easy start date by putting

them in separate equity accounts. If you decide to add additional equity

accounts, Auto Easy still adds the Retained Earnings and Net Income lines

on your balance sheet.

Equity accounts for sole proprietorships/trader

Since all the equity of a sole proprietorship/trader

company belongs to one person, tracking equity can be very simple. As

of your Auto Easy start date, all the equity is in the Opening Balance

Equity account. Keep the equity in this account and perhaps rename the

account to something like “Owner’s Equity.”

Note:

When setting up a new account for owner’s drawings, enter a negative opening

balance to show the total draws prior to the start date. The negative

opening balance indicates that the draws have reduced the company’s equity.

(Or, enter a zero opening balance and record drawings from now on)

Partnerships

Each partner may have invested in the partnership,

and each receives a specified share of profits. Since partners are not

employees, they don’t receive salaries or wages, but they may withdraw

money against their share of profits. As of your Auto Easy start date,

all the equity is in the Opening Balance Equity account. Set up separate

equity accounts for each partner.

If you don’t want to see further detail, the opening

balance for each partner’s equity account should equal the partner’s equity

as of your Auto Easy start date. Since the company’s equity belongs to

the partners, setting up new accounts should reduce the balance of opening

balance equity to zero. Record each partner’s capital investment, drawings,

and share of profits in the partner’s single equity account.

If you want to see further detail by adding sub-accounts,

the opening balance for each partners “parent” equity account should equal

zero.

(Optional) Add sub-accounts to provide the level

of detail you’d like to see on the chart of accounts and on the balance

sheet. For example, add sub-accounts for each partner’s investments, share

of profits, and drawings.

Company

In a company, you’ll usually want to separate the

stockholders investment of capital from the stockholders’ share of earnings.

To track paid-in capital or investments of shareholders, add an equity

account with a name such as “Capital Shares.” Although you do need to

have records of the names and investments of each stockholder, you probably

won’t want to show this detail on your chart of accounts. For the opening

balance, enter the total paid-in capital as of your Auto Easy start date.

After you have set up all your accounts, the amount remaining in Opening

Balance Equity represents retained earnings prior to the start date. You

can rename this account with a name such as “Prior Earnings” or “Pre 1999

Earnings.” Auto Easy automatically tracks the company’s retained earnings

for completed financial years in the Retained Earnings equity account.

After the end of the year, you may distribute some or all of the retained

earnings of the company to stockholders as dividends.

Journal

Entries

Journal

Entries, Overview: During

the course of business over a period of time you will make hundreds or

thousands of accounting entries. To help you manage your accounts Auto

Easy allows you to make journal entries. A journal entry is simply a way

of changing the balances of accounts.

All journal entries are double sided comprising

of a both a credit and debit entry to your accounts the balance of a journal

entry must always equal zero. It a journal does not balance Auto Easy

will not allow you to post the transaction.

|

|

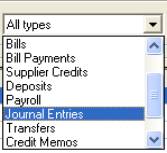

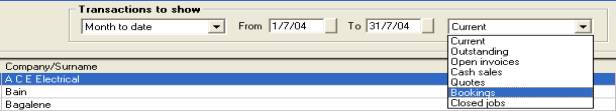

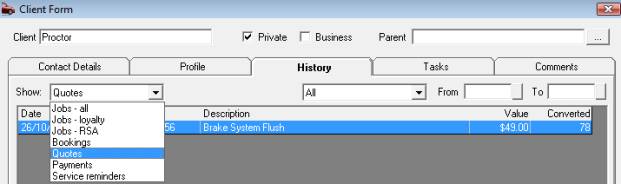

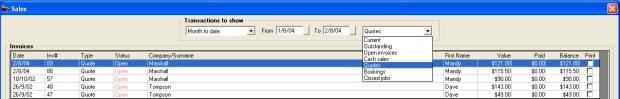

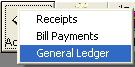

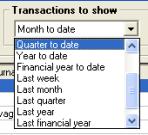

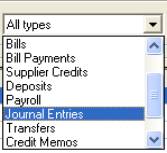

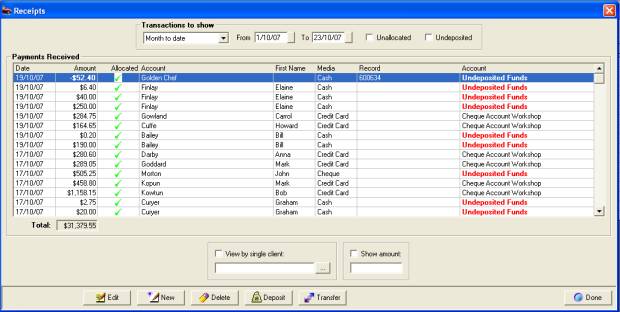

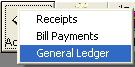

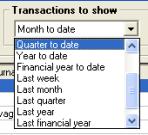

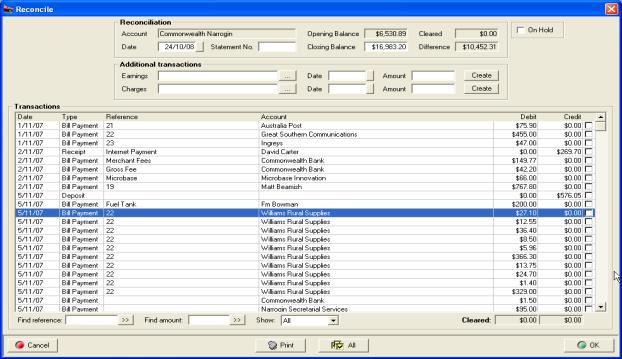

Journal

Entries, Displaying: To display

journal entries click on the accounts icon at the top of the screen and

select general ledger. The general ledger transaction journal is displayed.

To view journal entries only select the arrow to the right of the field

at the top of screen displaying All Types – select journals from the drop

down list. |

|

|

|

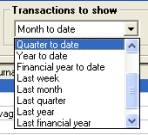

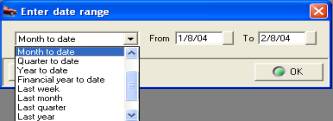

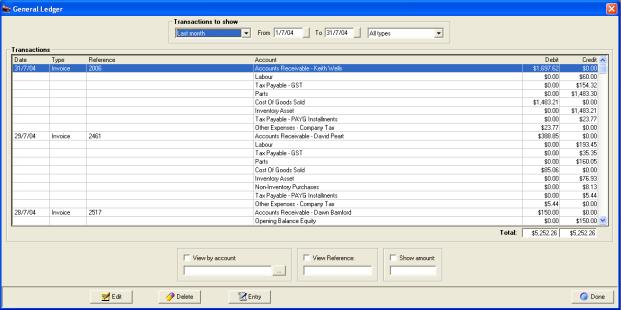

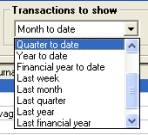

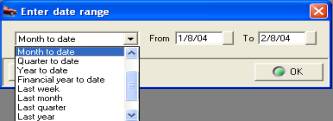

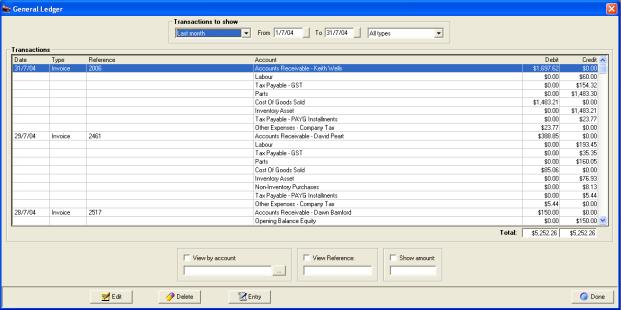

To filter journal

entries by date select the field at the top of the screen-displaying month

to date. Select the arrow to the right of the text. Next highlight the

period you wish to view or alternatively type the from to dates into the

date fields also located at the top of the form – selecting the arrows

on the right hand side allows you to pick from a calendar |

|

To display the details of a journal entry highlight

either the debit or credit entry and double mouse click or select edit

from the lower menu bar this action will display the journal entry form.

The form displays debit and credit entries including the date reference

number and any text memos.

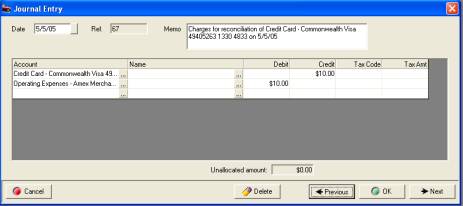

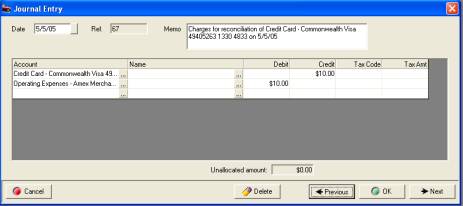

Journal

Entries, Creating: To

create a new journal transaction select the Entry button from the

bottom of the general ledger display or select admin / journal entries

from the top menu bar. Either of these actions will display the journal

form.

|

|

Fig 3.03 Journal Entry Form

To enter transaction details select the button to

the right of the first entry in the account field column.

You will see

a list of accounts, select the account you wish to debit or credit to,

double mouse click the account name is entered into the account field.

Next point at either the debit or credit fields, enter the value. ie:

Trading account enter a credit of say $20.11 (according to the principles

of double entry accounting a credit to your bank account will be logged

as a debit in your chart of accounts). |

|

|

|

|

|

Point at the field below the last account entry

and mouse click, from the account list select the account you wish to

make a debit entry to, we will select bank charges enter $20.11 into the

debit column. The transactions now balance and the unallocated amount

is zero.

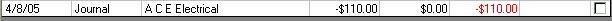

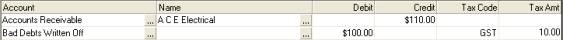

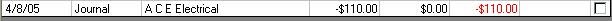

Journal

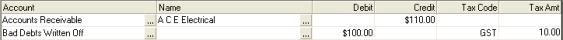

Entries, Using Tax Codes: You

may need to allocate an amount to tax when processing certain journals.

An example would be when adjusting a clients account to write off a bad

debt, say the amount to be written off was $110.00 you would credit the

clients account with $110.00 and split the opposing debit entry between

an expense account ($100.00) and GST ($10.00).

To apply tax to a journal select the tax code field

click on the down arrow, next point and click on the required tax code,

the tax amount is automatically calculated and placed into the tax amount

field. Tax is calculated on the value of the debit or credit entry entered

on the same line.

Journal

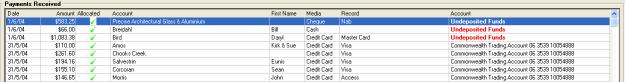

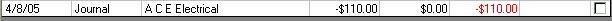

Entries, Adjusting Debtor And Creditor Accounts: Auto Easy allows you to adjust individual

accounts assigned to accounts receivable (Debtors) and accounts payable

(Creditors) with a journal entry. The entries are recorded in the bill

payments (creditors) and Receive Payments (Debtors) forms, payments and

receipts can be allocated to these transactions in the same way as process

bills and invoices.

To adjust a debtors account select the button to

the right of the account field, from the chart of accounts select accounts

receivable, the name field can now be accessed, point and click on the

button to the right of the field, from the client list select the client

you wish to raise the adjustment for, select OK from the bottom of the

client listing. The clients name is now displayed in the form.

If you wish to increase the balance of a debtors

account place the value (in tax) into the debit column on the same line

as the client’s name. Next select the account you wish to post to if there

is a tax value enter the excluding tax amount to the debit column on the

same line, to enter the tax value select the tax code and the calculated

value is automatically entered in the tax amount field. Note: That the

tax and debit or credit value can be changed, however the total credits

must always be equal to the total debits for the transaction to be posted.

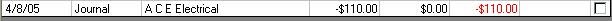

Journal entries are displayed in the following format

on the bill payment and receive payment forms

Receipts (Debtors)

Bill Payments (Creditors)

Ticking the box at the end of the line allows the

operator to allocate payments or receipts to a journal.

Note:

It is best to view your chart of accounts pre and post when entering journals,

this is an easy way to determine whether the transaction has debited and

credited the correct accounts. Do not worry if you get it wrong Auto Easy

allows for easy editing of journals.

Journal

Entries, Editing:

To edit a journal go to the general ledger by selecting the accounts /

general ledger option from the top menu bar. Search for the entry you

require, highlight and double click on the line item or select edit from

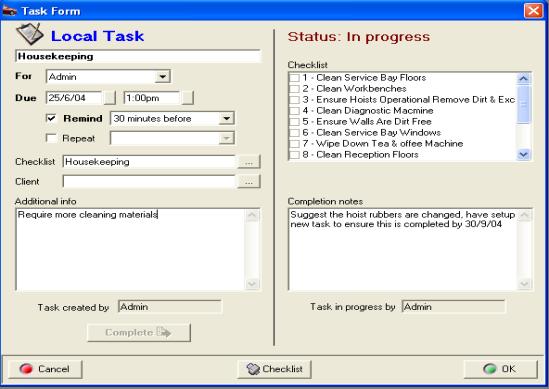

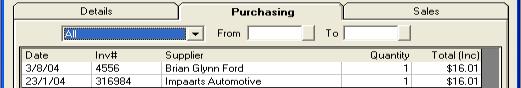

the lower menu bar. You can now alter any of the details except the reference